41

Management report

we take the varying risk levels inherent in different credit activities

duly into account. In the process, particular attention is devoted to

the risks of foreign currency loans and repayment vehicles.

The sales units are supported by the risk management department

in the management process through the measurement and mon-

itoring of credit risk and impending macroeconomic risks, and by

the credit management department in the operational management

of normal and problematic exposures. In the reporting system, var-

ious reference date and forecast analyses form an integral part of

the risk profile. This helps to guarantee an active across-the-board

risk management process.

The various credit-risk-related tasks and organisational processes

as well as the credit risk strategy laid down annually by the man-

agement board are clearly described on the intranet, in the cred-

it manual and in the product manuals. Furthermore, all employees

involved in the execution of transactions are instructed in these

tasks and processes, which are also available online. This ensures

in every individual case that any risk taken is in compliance with

our risk policies and risk strategy. In addition, in keeping with prin-

ciples of commercial prudence, ample provision is made for all ex-

isting risks.

The regulatory capital requirement for the credit risk is ascertained

in accordance with the standard rate and the regulatory capital re-

quirement for the CVA risk in accordance with the standard method.

In line with supervisory requirements and recommendations, as

well as potential operational benefits, Raiffeisen-Landesbank Tirol

AG has set itself the goal of continuously developing and improv-

ing its risk management processes as well as its risk evaluation and

monitoring methods.

Market risk

Market risk is the risk of interest rate, exchange rate, price and

spread changes adversely affecting securities, interest and curren-

cy positions. Market risk is generated by both bank book and trad-

ing book transactions.

Raiffeisen-Landesbank Tirol AG uses a combination of risk mea-

surement parameters to manage market risks and set associated

limits. The treasury department manages market risk, systemati-

cally compiling all interest-, currency- and price-sensitive positions

and controlling them in line with the prevailing market situation.

Alongside the credit business, the bank’s own account trading

constitutes another core line of business.

The risk management organisational unit helps the treasury organ-

isational unit to control market risks. The measurement and mon-

itoring of market risk and regular reporting are the central tasks

in this respect. The dynamic risk-monitoring process involves giv-

ing particular emphasis to the systematic monitoring of strate-

gic and hedging positions. Daily risk and performance analyses

and reports ensure that the treasury department provides appro-

priate steering momentum. In doing so, Raiffeisen-Landesbank Ti-

rol AG uses, in particular, interest rate swaps, cross-currency swaps

and interest rate options. For these derivatives, the market values

are calculated, the limits are monitored and any necessary con-

trol measures are carried out on a daily basis. Derivatives are used

predominantly for hedging interest rate risks inherent in purchased

bonds, issues or from customer positions (micro-hedge) and for

hedging the foreign currency risk. An overview detailing the struc-

ture of these transactions can be found in the notes under ‘Supple-

mentary details’.

Liquidity risk

At Raiffeisen-Landesbank Tirol AG, we set great store by refinanc-

ing with matching maturities. This policy is supported by a key li-

quidity figures system and associated limits, duly distinguishing in

this area between short-term (operational) and longer-term (struc-

tural) liquidity management as well as liquidity price risk. The unex-

pected withdrawal of customer deposits is classified as short-term

liquidity risk, while increased own refinancing costs as a result of

the refinancing structure are classified as a structural liquidity risk

or liquidity price risk. The liquidity risks are managed by the treas-

ury department. The liquidity coverage ratio (LCR) – which accord-

ing to the supervisory authorities must already be complied with

– and, looking ahead, the net stable funding ratio (NSFR) are like-

wise the focus of attention in this respect.

Compliance with limits is monitored by the risk management de-

partment. Various liquidity scenarios are used to simulate ade-

quate supplies of short- and long-term liquidity during hypothetical

financial squeezes. To reinforce its liquidity, Raiffeisen-Landesbank

Tirol AG attaches great importance to factors such as issuance ac-

tivity and the available refinanceable collateral. Additional steer-

ing instruments are continuously being developed in furtherance of

proactive liquidity steering, something which will increase in impor-

tance with the implementation of Basel III.

In order to safeguard the supply of liquidity, an appropriately large

bond portfolio with the emphasis on highly liquid securities is

maintained.

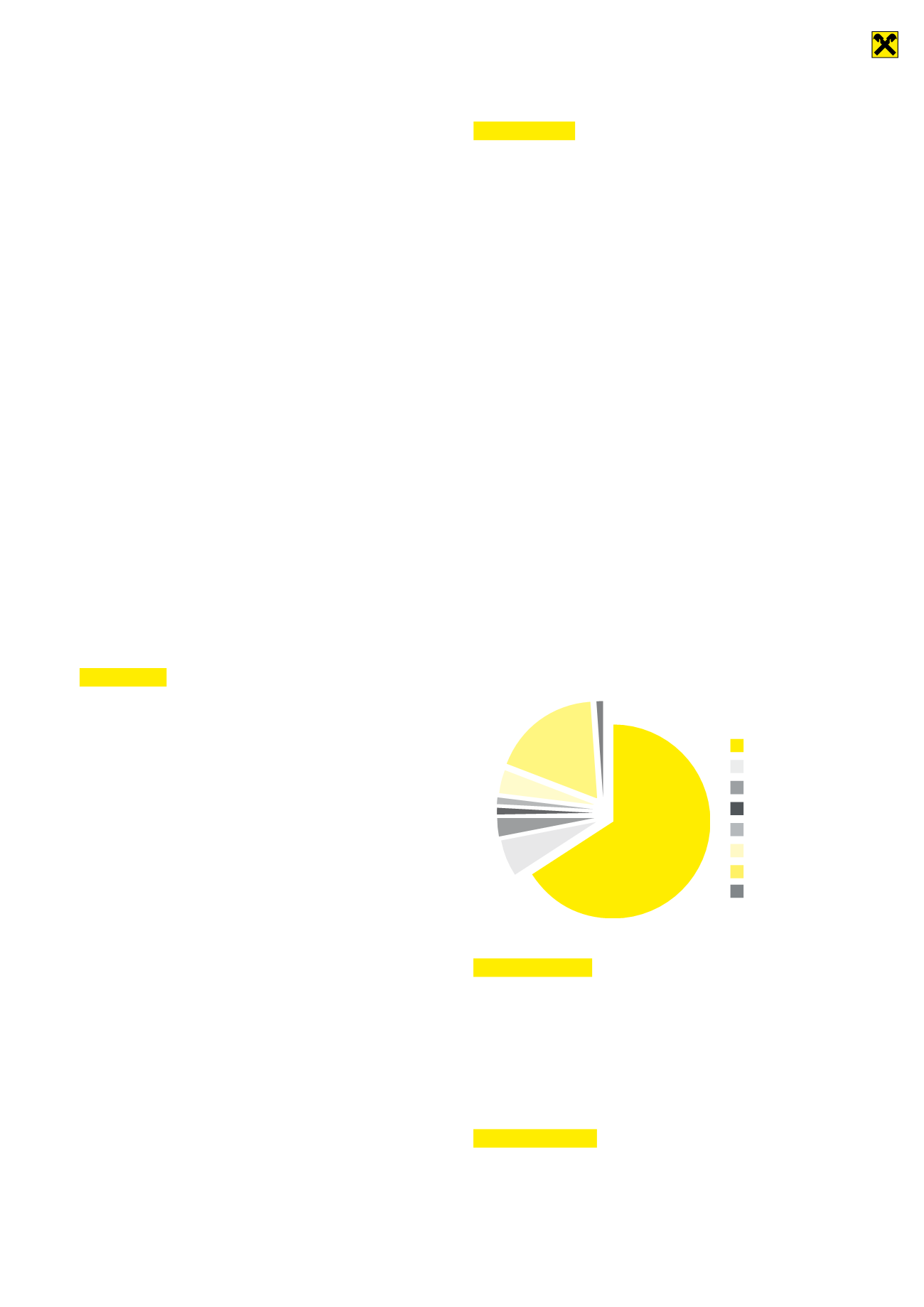

Rating grades as proportions of overall bond portfolio as at

31.12.2015

Investment risk

Investment risk is steered by the management board, measured by

the risk management department and monitored by the finance de-

partment.

An expert approach ensures the appropriate assessment of poten-

tial risk.

Operational risk

The management of operational risk is the task of the risk manage-

ment organisational unit. All potential risks that can result from

66%

6%

3%

1%

1%

1%

4%

18%

Aaa

Aa1

Aa2

Aa3

A2

Baa1

Baa2

NR