37

Management report

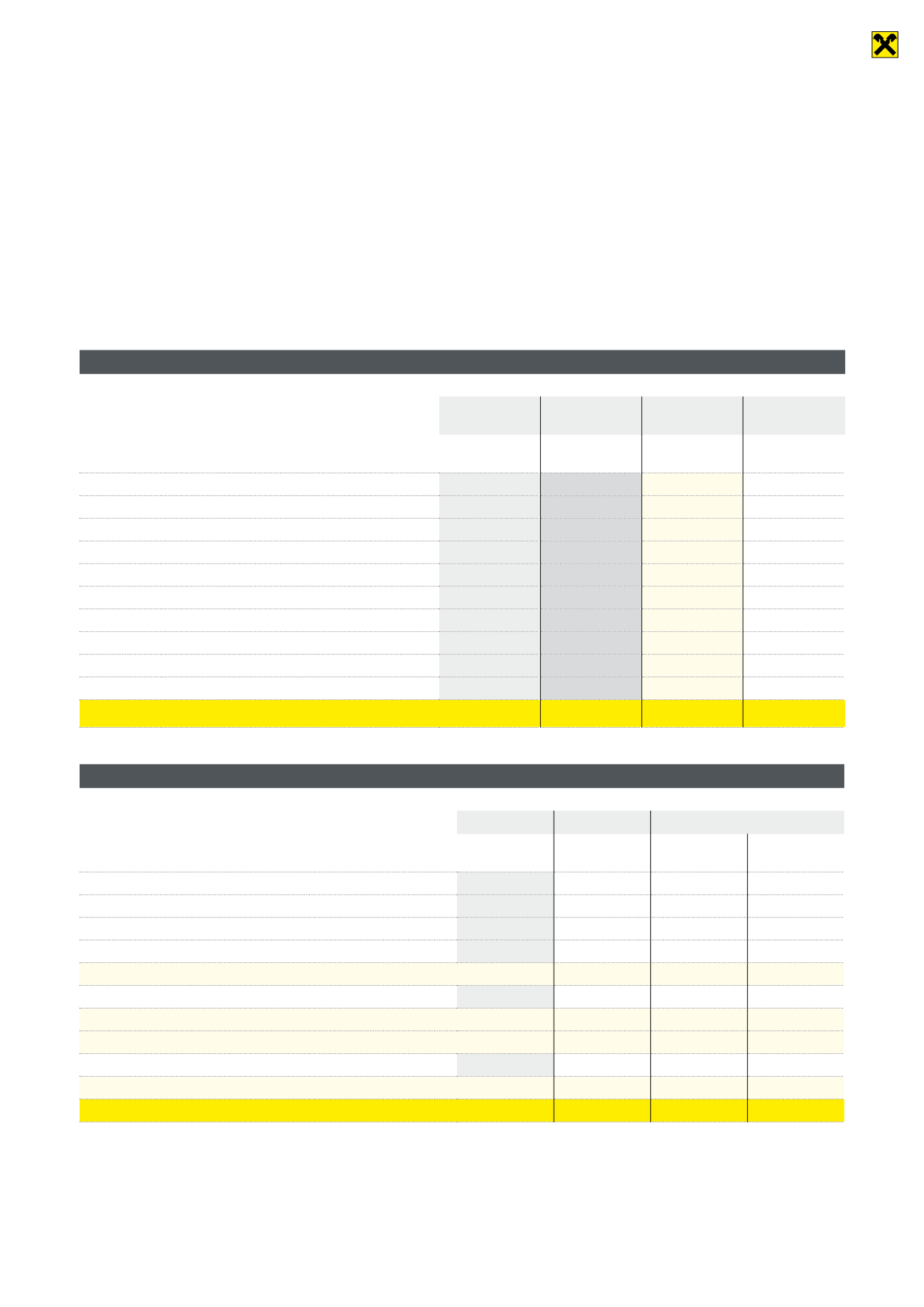

As at the end of 2015, receivables from customers broke down as follows:

RLB Tirol AG 2015 breakdown by sector

2015

2014

Change Proportion of

total loans

Thousands of

euros

Thousands of

euros

Per cent

Per cent

Agriculture, forestry and cooperatives

25,826

25,444

1.5%

1.1%

Transport

156,620

141,420

10.7%

6.5%

Trade

473,221

476,081

–0.6%

19.6%

Manufacturing industry

84,212

98,370

–14.4%

3.5%

Employed persons, private

457,357

435,359

5.1%

19.0%

Tourism and leisure industry

401,707

371,539

8.1%

16.6%

Public-sector and social insurance

113,260

108,774

4.1%

4.7%

Self-employed persons

61,773

56,979

8.4%

2.6%

Commerce

158,568

158,353

0.1%

6.6%

Other (residential building associations and other non-banks)

480,809

481,040

0.0%

19.9%

Total

2,413,353

2,353,359

2.5%

100.0%

Regulatory capital (pursuant to article 25 of the CRR)

31.12.2015 31.12.2014

Change

Thousands of

euros

Thousands of

euros

Thousands of

euros

Per cent

Subscribed capital

84,950

84,950

Reserves

79,343

79,343

Core capital

153,680

145,160

Supplementary capital

72,926

72,091

CORE CAPITAL before deductions

390,899

381,544

9,355

2.5%

Deductions

–192

0

CORE CAPITAL

390,707

381,544

9,163

2.4%

SUPPLEMENTARY CAPITAL before deductions

33,245

29,573

Deductions

–832

–70

SUPPLEMENTARY CAPITAL

32,413

29,503

2,910

9.9%

REGULATORY CAPITAL

423,120

411,047

12,073

2.9%

On the assets side, higher loans and advances to banks and

customers in particular, as well as the securities portfolio, con-

tributed to an upward trend. Receivables from banks increased

from 2,595 million euros to 2,786 million euros. This constitutes

an increase of 7.4 per cent. Receivables from customers totalled

2,413 million euros in 2015, thereby generating an increase of

60 million euros, or 2.5 per cent, compared to 2014. In addition

to that, securities holdings increased by 7.3 per cent from 1,783

million euros to 1,914 million euros. Participating interests, in-

cluding shares in affiliated companies, were 10.0 per cent down

on the previous year and totalled 207 million euros as at 31 De-

cember 2015. Other assets, too, endured a negative trend that

reduced them from 118 million euros to 103 million euros, a de-

cline of 12.7 per cent.