38

Management report

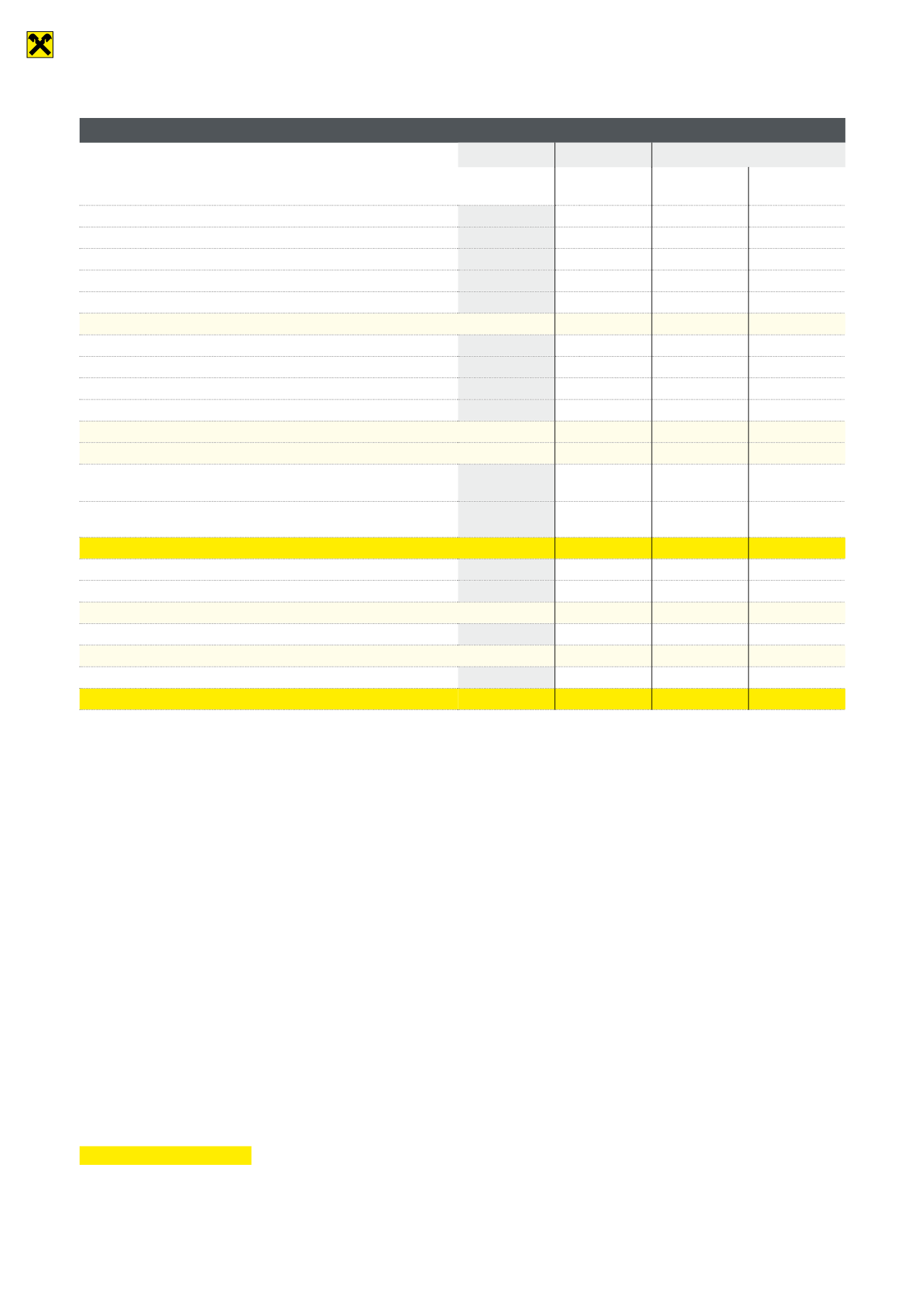

Income statement

2015

2014

Change

Millions of

euros

Millions of

euros

Millions of

euros

Per cent

Net interest income

50.9

54.9

–4.0

–7.3%

Income from securities and investments

8.9

17.5

–8.6

–49.1%

Commission income

22.6

22.1

0.5

2.3%

Income from financial transactions

1.6

2.1

–0.5

–23.8%

Other operating income

10.5

11.1

–0.6

–5.4%

OPERATING INCOME

94.5

107.7

–13.2

–12.3%

Personnel costs

–31.8

–33.9

–2.1

–6.2%

Other administrative costs (operating expenses)

–25.9

–26.1

–0.2

–0.8%

Impairment losses on assets

–2.4

–2.4

0.0

0.0%

Other operating costs

–4.1

–3.0

1.1

36.7%

TOTAL OPERATING COSTS

–64.2

–65.4

–1.2

–1.8%

OPERATING PROFIT

30.3

42.3

–12.0

–28.4%

Net expense for impairment

losses on receivables

–12.4

–19.0

6.6

–34.7%

Net expense for impairment losses on

securities and participating interests

2.7

3.2

–0.5

–15.6%

Profit from ordinary business activities

20.6

26.5

–5.9

–22.3%

Taxes on income

–2.3

0.3

–2.0

n/a

Other taxes not posted under previous item

–5.9

–5.8

–0.1

1.7%

NET PROFIT

12.4

21.0

–8.6

–41.0%

Movements in reserves

–10.7

–12.5

–1.8

–14.4%

ANNUAL PROFIT

1.7

8.5

–6.8

–80.0%

Profit carried forward

0.0

0.0

0.0

0.0%

Net income

1.7

8.5

–6.8

–80.0%

In the financial year 2015, operating income decreased by 12.3 per

cent from 107.7 million euros to 94.5 million euros. This development

is attributable primarily to lower income from securities and partic-

ipating interests. This decreased by 8.6 million euros compared to

the previous year. Likewise on a downward trend were net interest in-

come, which decreased by 4.0 million euros, or 7.3 per cent, income

from financial transactions, which were down by 2.1 million euros,

or 23.8 per cent, to 1.6 million euros, and other operating income,

which declined by 0.6 million euros, or 5.4 per cent, to 10.5 million

euros. Commission income increased by 2.3 per cent from 22.1 mil-

lion euros to 22.6 million euros. This constitutes an improvement of

0.5 million compared to the previous year.

Operating costs were reduced slightly by 1.2 million euros, or 1.8

per cent, from 65.4 million euros to 64.2 million euros, which can

be attributed to the decrease of 2.1 million euros, or 6.2 per cent,

in personnel costs from 33.9 million euros to 31.8 million euros,

and to the downward trend in other administrative costs, which de-

creased by 0.2 million euros, or 0.8 per cent, from 26.1 million eu-

ros to 25.9 million euros. Valuation allowances for assets remained

unchanged compared to the previous year at 2.4 million euros.

Other operating costs, by contrast, increased by 36.7 per cent, or

1.1 million euros, to 4.1 million euros. The negative balance from

reversals of and allocations to impairment losses on receivables

was 6.6 million euros lower than in the previous year. This corre-

sponds to a year-on-year change of 19.0 million to 12.4 million

euros. The balance of reversals of and allocations to impairment

losses on securities and participating interests totalled 2.7 million

euros at the end of the year, down by 0.5 million euros, or 15.6 per

cent, compared to the previous year. The profit from ordinary activ-

ities decreased by 5.9 million euros compared to 2014 and totalled

20.6 million euros.

Taxes on income increased in the financial year 2015 by 2.7 mil-

lion euros.

The net profit for the year as at year end totalled 12.4 million euros,

which was 8.6 million euros, or 41 per cent, lower than in 2014.

Changes in reserves totalled 10.7 million euros. This represents a

reduction of 1.8 million euros, or 14.4 per cent.

At 1.7 million euros, the profit for the year was 6.8 million euros be-

low that of 2014.

Bank branches report

As at 31 December 2015 (2014), Raiffeisen-Landesbank Tirol AG

was operating 12 (13) bank branches and 10 (9) self-service out-

lets in the market territory, with one bank branch converting to a

self-service outlet in the year under review. All in all, the person-

nel at Raiffeisen-Landesbank Tirol AG – as in the previous year –

looked after the banking needs of around 68,000 customers.