40

Management report

Risk report

Modern risk management

Raiffeisen-Landesbank Tirol AG attaches great importance to ac-

tive risk management, which safeguards our long-term success. In

keeping with statutory requirements, Raiffeisen-Landesbank Tirol

AG has set itself the goal of applying effective methods and suit-

able systems by means of recording, assessing, limiting, steering,

monitoring and reporting the risks in order to guarantee the bank’s

security and profitability in the interests of our customers and own-

ers. Our experiences during 2015 have confirmed the effectiveness

of our risk policies, risk management and their organisation.

Principles of risk policy

Our risk policy principles lay down the central rules of conduct for

dealing with risk. They lay the foundation for a unified understand-

ing of the bank’s global objectives with regard to risk management.

• The management board and all our employees are committed

to the risk policy principles and comply with them in their day-to-

day decision-making.

• In the case of non-transparent risk positions or methodological

uncertainties, we apply the prudence concept.

• Our risk management is geared towards the goal of ensuring the

company’s continued existence.

• Careful analysis of the specific risks is essential before introduc-

ing new lines of business or products (the product launch pro-

cess).

Our risk policy principles are laid down by the management board

and are regularly reviewed and adjusted as necessary.

Risk management principles

Our risk management is based on the following principles:

• The management board takes overall responsibility for moni-

toring risk management at Raiffeisen-Landesbank Tirol AG. The

risk committee which is required by law and convened by the

supervisory board checks and monitors the risk strategy at regu-

lar – at least annual – intervals.

• The management of all types of risk, especially credit, market,

liquidity, investment, operational, macroeconomic and other

risks, is a coordinated process involving all relevant levels with-

in the bank.

• As the central body reporting to the management board, the risk

committee issues recommendations concerning risk strategy, in-

cluding specific strategies in relation to the individual risk cate-

gories and the limitation of risk capital in line with our risk-bear-

ing ability and risk capital allocation.

Risk management organisation

The risk management system is organised with a view to avoiding

conflicts of interest at both the personal and organisational levels

(separation of trading and back-office supervisory functions). The

tasks and organisational processes involved in the measurement,

monitoring and reporting of risks are the responsibility of the risk

management department and are laid down on the intranet and in

the appropriate manuals.

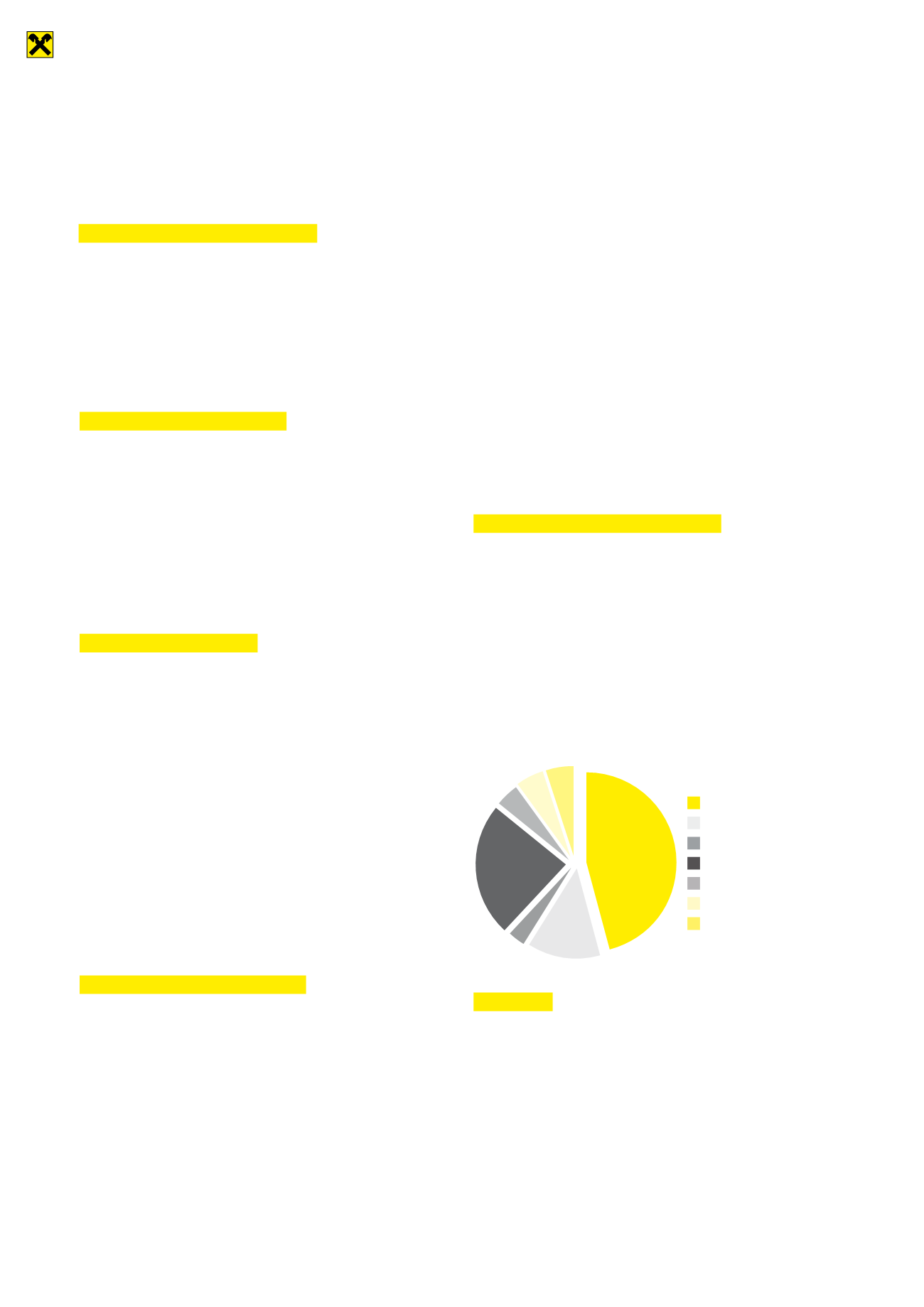

Risk categories as proportions of overall bank risk as at

31.12.2015.

Events after the reporting date

To date there have been no business cases or other transactions

that would be of special public interest or have a significant impact

on the 2015 financial statements.

Credit risk

Market risk

Liquidity risk

Investment risk

Operational risk

Macroeconomic risk

Buffer, other risks

46%

13%

3%

4%

5%

5%

24%

Credit risk

The credit risk is evaluated for both counterparties (private and

commercial customers, banks and countries) and concentrations.

The country risk and the credit value adjustment risk (CVA risk) are

likewise included under the credit risk.

Granting credit and the judicious assumption of risk are among

Raiffeisen-Landesbank Tirol AG’s core lines of business. Borrowers’

risk situations are continuously and two-dimensionally managed –

on the one hand by assessing their economic situation using our

in-house rating systems, and on the other hand through the evalu-

ation of risk-reducing collateral. In the corresponding calculations,

Agenda-setting role within RBGT

Supporting Tyrolean Raiffeisen banks is the founding mission of

Raiffeisen-Landesbank Tirol AG and an essential component of

its performance spectrum. The common strategy of the Raiffeisen

Banking Group Tyrol forms the basis for the services offered, which

can be provided either centrally or, if desired, locally. To ensure a

successful common future, Raiffeisen-Landesbank Tirol AG sits on

both state-level and national boards and committees, using its role

as an agenda setter to give support and impetus for the Tyrolean

Raiffeisen banks.