54

Annual financial statements

Notes to the balance sheet

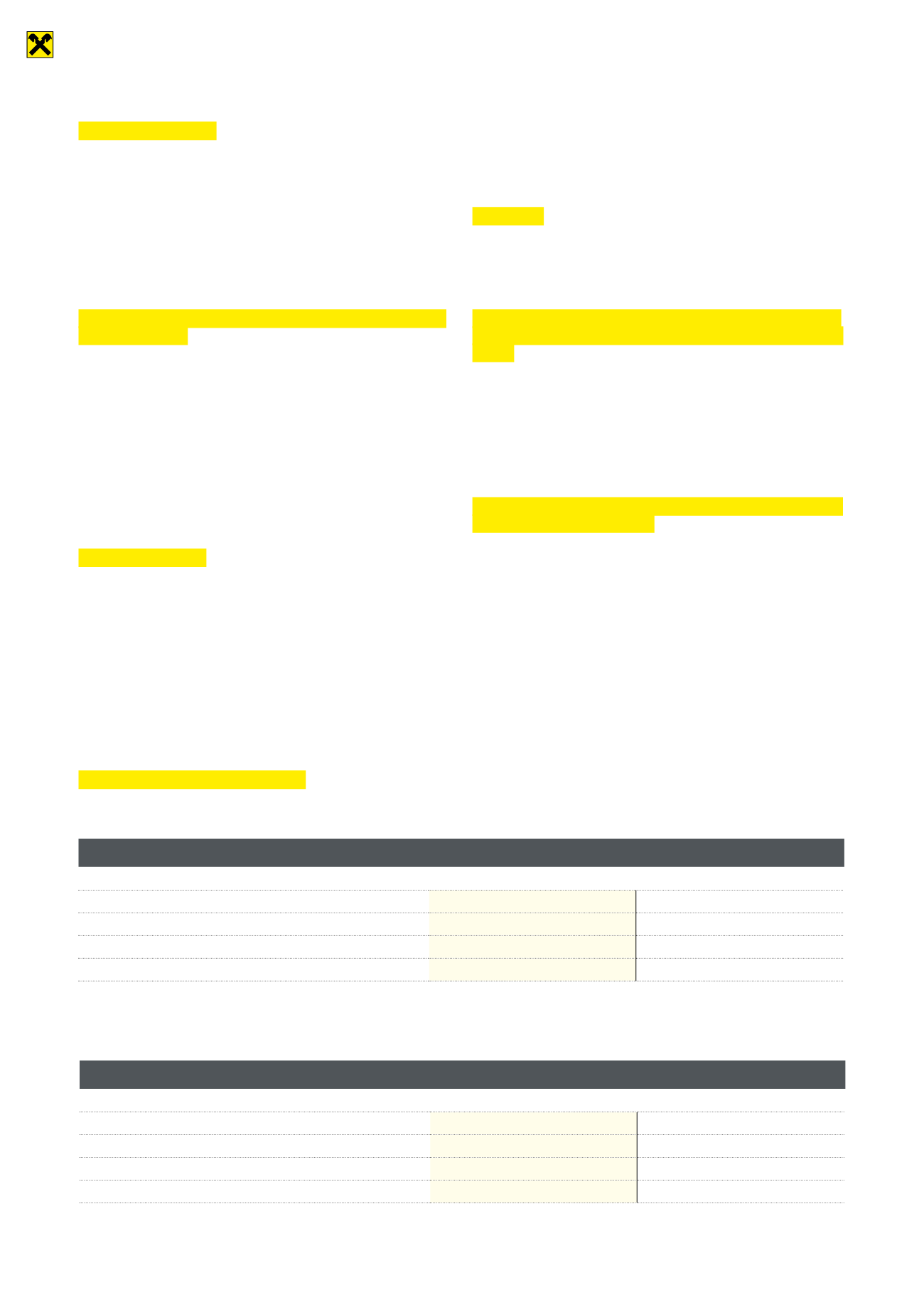

Breakdown of maturity dates

The maturity dates of receivables from banks not maturing daily break down as follows:

Remaining term

31.12.2015

Previous year

In euros

In thousands of euros

Up to 3 months

280,254,673

329,771

3 months to 1 year

565,045,490

527,427

1 year to 5 years

727,973,453

652,337

5 years or more

207,643,702

85,868

Remaining term

31.12.2015

Previous year

In euros

In thousands of euros

Up to 3 months

117,522,855

113,958

3 months to 1 year

455,205,230

387,632

1 year to 5 years

738,982,502

717,117

5 years or more

1,014,032,108

1,002,338

The maturity dates of receivables from non-banks not maturing daily are classified as follows:

Pension provision

The pension provision has been calculated according to recog-

nised actuarial principles, applying the entry age normal method,

based on an actuarial interest rate of one per cent (previous year:

two per cent) using the Pagler & Pagler mortality tables (AVÖ 2008)

and taking the individual retirement age into account. No staff turn-

over deduction is made. Monetary value adjustments are allowed

for by using the real interest rate.

Provisions for redundancy payments and simi-

lar obligations

Provisions for redundancy payment obligations as of the balance

sheet date have been calculated according to principles of mathe-

matical finance, applying an interest rate of one per cent (previous

year: two per cent) and taking the individual statutory retirement

age into account. Provisions for the obligation to pay long-service

bonuses have been calculated according to principles of mathe-

matical finance in similar fashion to the redundancy payment obli-

gations. No staff turnover deduction is made. Monetary value ad-

justments are allowed for by using the real interest rate.

Other provisions

Applying the prudence principle, the other provisions take into ac-

count all discernible risks at the time of preparing these state-

ments, as well as all probable or certain liabilities of uncertain pro-

portions, for the purpose of setting aside the amounts that are

necessary in our reasonable commercial judgement.

Liabilities

Liabilities are recognised at the higher of their nominal value or re-

demption value.

Impact of the change in balance sheet classifi-

cation pursuant to annex 2 to section 43 of the

BWG

The amount reported in sub-item 5 was adjusted on grounds of the

FMA’s requirements in the financial year 2015 and is not compa-

rable with the previous year. In a deviation from the previous year,

in which the capital requirement was reported, the total amount of

risk was reported.

Reference to the disclosure media pursuant to

section 434 of the CRR

Pursuant to section 434 of the CRR, banks are required to disclose

information about their organisational structure, risk management

and risk capital situation at least once a year. This information is

published on the Raiffeisen-Landesbank Tirol AG website (www.

rlb-tirol.at).