55

Annual financial statements

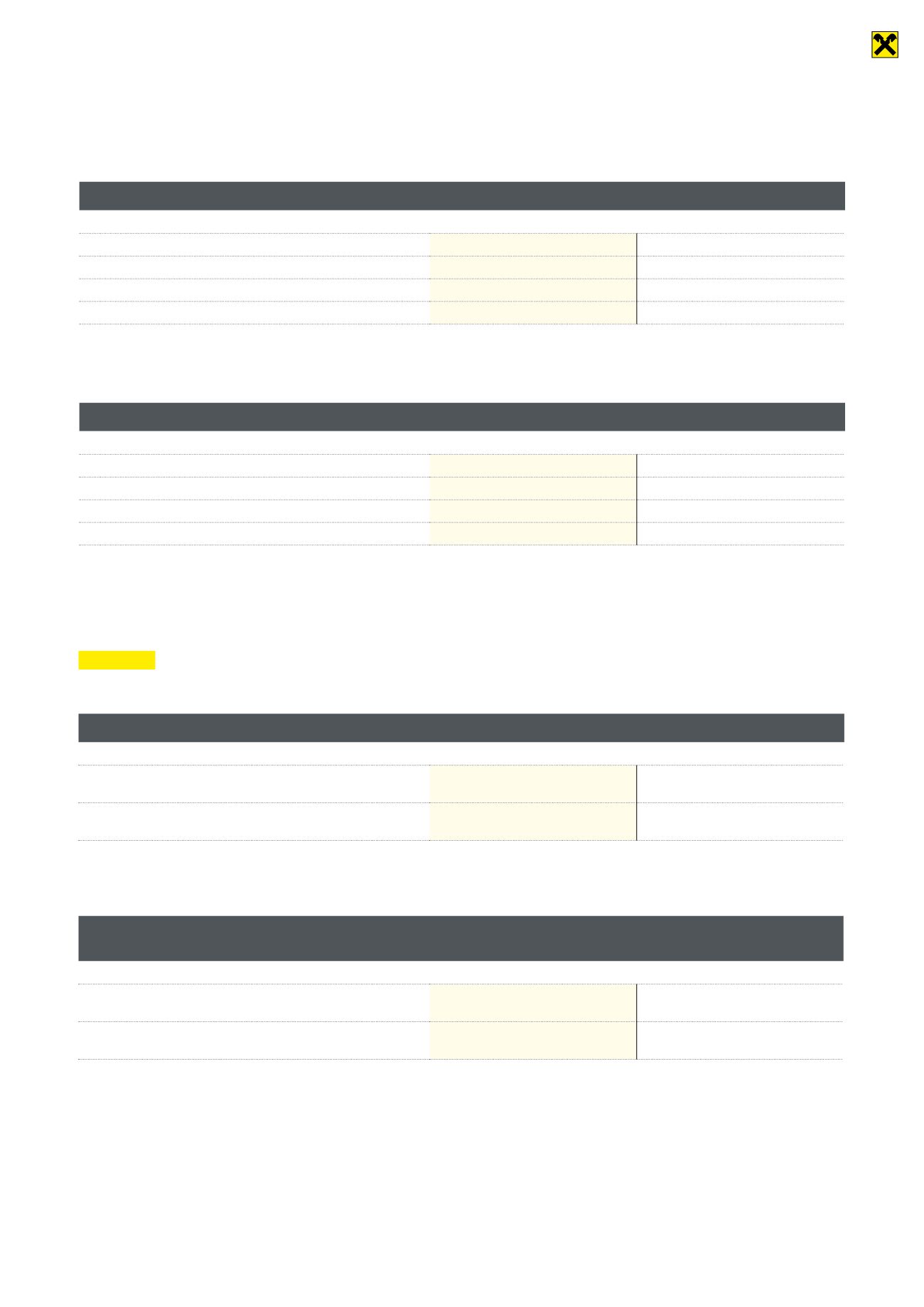

Description

Valued as

fixed assets

Not valued as

fixed assets

In euros

In euros

Debt securities and other fixed-interest securities

Previous year (in thousands of euros)

845,464,487

(731,666)

5,049,520

(7,787)

Equities and other variable-interest securities

Previous year (in thousands of euros)

1,977,440

(1,995)

0

(0)

The securities admitted for trading (see asset items 5 and 6) are classified according to the nature of their valuation as follows:

The listed securities are held for long-term investment purpos-

es. The securities not valued as fixed assets are procured for se-

curities trading purposes. Raiffeisen-Landesbank Tirol AG keeps

a small securities trading book. As at the balance sheet date, the

book value of the trading book positions amounted to 17,389 eu-

ros (previous year: 79,000 euros).

Securities

The securities admitted for trading (see asset items 5 and 6) are classified as listed and unlisted as follows:

Description

Listed

Unlisted

In euros

In euros

Debt securities and other fixed-interest securities

Previous year (in thousands of euros)

850,514,007

(739,453)

0

(0)

Equities and other variable-interest securities

Previous year (in thousands of euros)

1,977,440

(1,995)

0

(0)

Remaining term

31.12.2015

Previous year

In euros

In thousands of euros

Up to 3 months

940,463,788

704,654

3 months to 1 year

379,521,925

191,838

1 year to 5 years

460,345,000

430,766

5 years or more

515,887,500

438,337

The maturity dates of liabilities to banks not maturing daily break down as follows:

Remaining term

31.12.2015

Previous year

In euros

In thousands of euros

Up to 3 months

265,938,565

249,202

3 months to 1 year

329,441,371

339,277

1 year to 5 years

249,581,567

218,131

5 years or more

286,524,651

325,789

The maturity dates of liabilities to non-banks not maturing daily are classified as follows:

In 2016, debt securities and other fixed-interest securities held beneficially in the amount of 111,706,734 euros (previous year: 16,226,000

euros) are going to mature.