58

Annual financial statements

Raiffeisen-Landesbank Tirol AG has no derivative financial instru-

ments in its trading book. Derivative financial instruments are rec-

ognised at their fair values, with ‘fair value’ meaning the value of an

item on a specified date.

For derivatives, the value is determined on the basis of the fair mar-

ket value, which is the amount for which an asset could be ex-

changed, or a liability settled, between knowledgeable, willing

parties in an arm’s-length transaction. If quoted prices on active

markets are available, these are used for valuation purposes. In the

case of financial instruments with no stock market price, we use in-

ternal measurement models applying current market parameters,

in particular the cash value method and the option price model.

Raiffeisen-Landesbank Tirol AG uses derivatives to hedge both mar-

ket risks (in particular interest risks and fair-value hedge interest

rate risk) and the interest result for certain financial assets, liabilities

and executory contracts. The underlying transactions are holdings

of RLB’s own securities, issues and promissory notes, registered

bonds, term deposits at banks, customer deposits, customer bor-

rowings and derivatives. The hedging transactions are interest rate

swaps, forward rate agreements and interest rate options.

In the financial year 2015, obligations for close-out netting agree-

ments were posted in the amount of 688,000 euros (previous year:

0 euros) under other operating income in the amount of 301,000

euros (previous year: 602,000 euros), under other operating ex-

penses and 115,000 euros (previous year: 0 euros) under impair-

ments of securities and investments.

The aim of these activities is to reduce income volatility. Deriva-

tive transactions not offset by proven hedging mechanisms should

be valued by application of the imparity principle. A proven mi-

cro-hedging relationship allows the simultaneous recognition of

counteracting effects in the underlying transaction.

The effectiveness of the various hedging interrelationships is mea-

sured chiefly by demonstrating the counteraction of key parame-

ters of the underlying and hedging transactions. This critical term

match constitutes evidence of effectiveness both prospectively

and retrospectively. For the remaining exposures, this is done by

matching the basis point values. By effectiveness in this context

we mean the relationship between the change as a result of hedg-

ing the underlying transaction in the cash value (of that underly-

ing transaction) and the change in the cash value of the derivative

used for hedging purposes. Raiffeisen-Landesbank Tirol AG rec-

ognises hedging relationships as such only if they are likely to be-

come effective during their entire term.

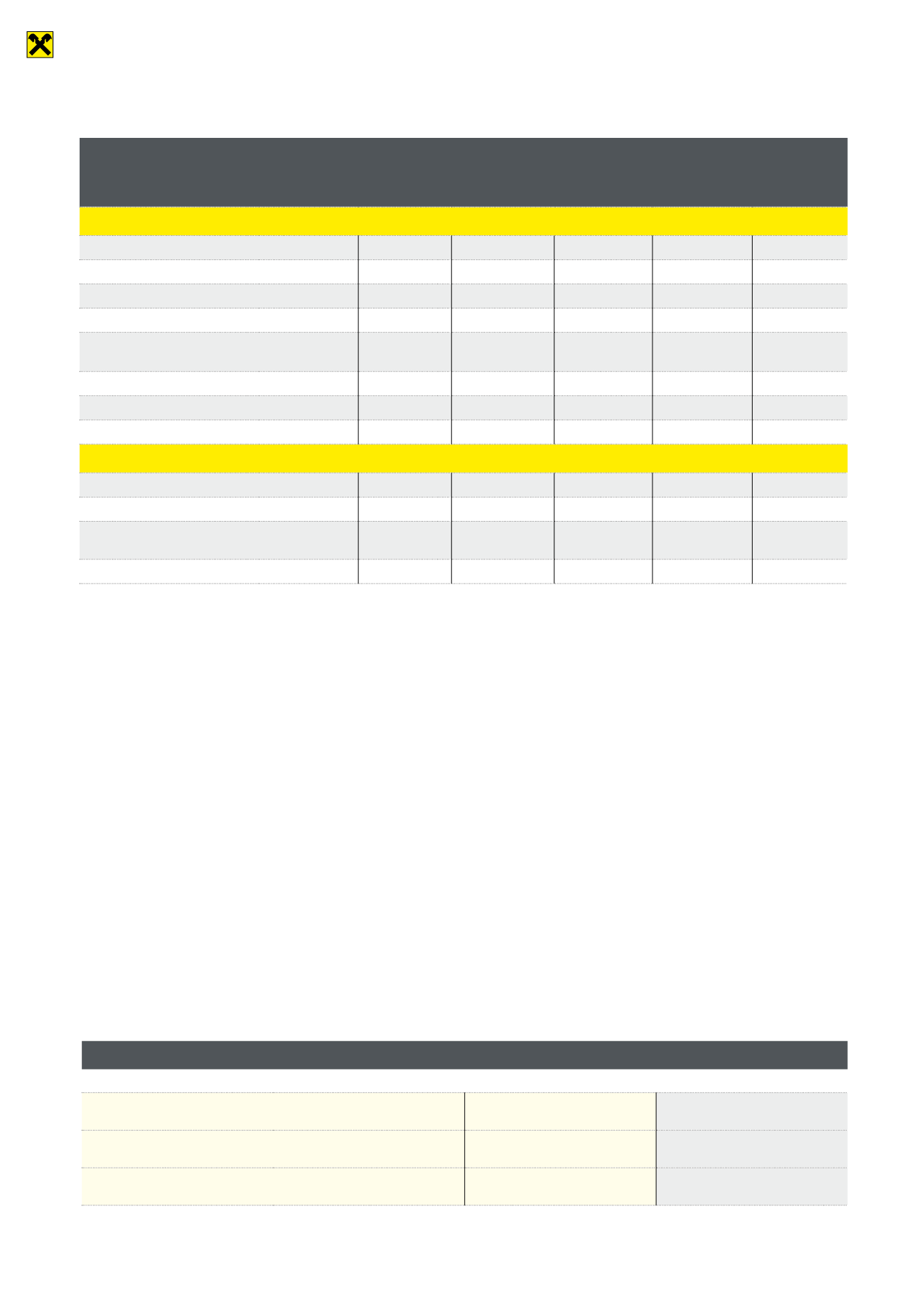

As of the balance sheet date, we held the following derivative financial instruments (in thousands of euros):

Category and type

Banking

book

Remaining terms of nominal values

Market

value,

positive

Market

value,

negative

Up to 1

year

1 to 5 years 5 or more

years

Interest rate derivatives

Interest rate swaps

4,478,982

614,591

1,479,044

2,385,347

121,109

298,037

Previous year

(4,558,872)

(648,817)

(1,705,096)

(2,204,959)

(177,464)

(343,726)

Interest rate futures – sale

0

0

0

0

0

0

Previous year

0

0

0

0

0

0

Interest rate options – pur-

chase

229,279

8,147

141,263

79,869

6,730

485

Previous year

(240,209)

(1,189)

(136,680)

(102,340)

(7,363)

(305)

Interest rate options – sale

257,900

8,147

178,615

71,138

705

7,829

Previous year

(274,332)

(1,189)

(173,767)

(99,376)

(528)

(8,958)

Exchange rate derivatives

Currency futures

0

0

0

0

0

0

Previous year

(464)

(464)

(0)

(0)

(8)

(11)

Currency and interest rate

swaps

826,971

211,221

329,622

286,128

6,000

17,811

Previous year

(1,238,546)

(348,747)

(414,697)

(475,102)

(8,992)

(19,345)

A provision totalling 2,320,000 euros for open interest rate swaps was formed in the financial year under review (previous year: 3,060,000

euros).

Hedge derivatives

Fair value Negative market value

In euros

In euros

Cap floor

Previous year (in thousands of euros)

–878,489

(–1,371)

–8,314,113

(–9,262)

Swaps

Previous year (in thousands of euros)

–175,434,785

(–166,893)

–270,051,486

(–311,133)

Total

Previous year (in thousands of euros)

–176,313,274

(–168,264)

–278,365,599

(–320,395)