43

Annual financial statements

RLB Tirol AG does not have any derivative financial instruments in its trading book.

Derivative financial instruments are recognised at their fair values, with ‘fair value’ meaning the value of an item on a specified date.

For derivatives, the value is determined on the basis of the fair market value, which is the amount for which an asset could be exchanged,

or a liability settled, between knowledgeable, willing parties in an arm’s-length transaction. If quoted prices on active markets are available,

these are used for valuation purposes. In the case of financial instruments with no stock market price, we use internal measurement

models applying current market parameters, in particular the cash value method and the option price model.

RLB Tirol uses derivatives to hedge both market risks (in particular interest risks and fair-value hedge interest rate risk) and the interest

result for certain financial assets, liabilities and executory contracts. The underlying transactions are holdings of RLB’s own securities,

issues and promissory notes, registered bonds, term deposits at banks, customer deposits, customer borrowings and derivatives. The

hedging transactions are interest rate swaps, forward rate agreements and interest rate options.

In the financial year 2014, obligations for close-out netting agreements were posted in the amount of 602,459 euros under other operating

costs.

The aim of these activities is to reduce income volatility. Derivative transactions not offset by proven hedging mechanisms should be

valued by application of the imparity principle. A proven micro-hedging relationship allows the simultaneous recognition of counteracting

effects in the underlying transaction.

The effectiveness of the various hedging interrelationships is measured chiefly by demonstrating the counteraction of key parameters

of the underlying and hedging transactions. This critical term match constitutes evidence of effectiveness both prospectively and

retrospectively. For the remaining exposures, this is done by matching the basis point values. By effectiveness in this context we mean the

relationship between the change as a result of hedging the underlying in the cash value (of that underlying) and the change in the cash

value of the derivative used for hedging purposes. RLB Tirol only recognises hedging relationships as such if they are likely to become

effective during their entire term.

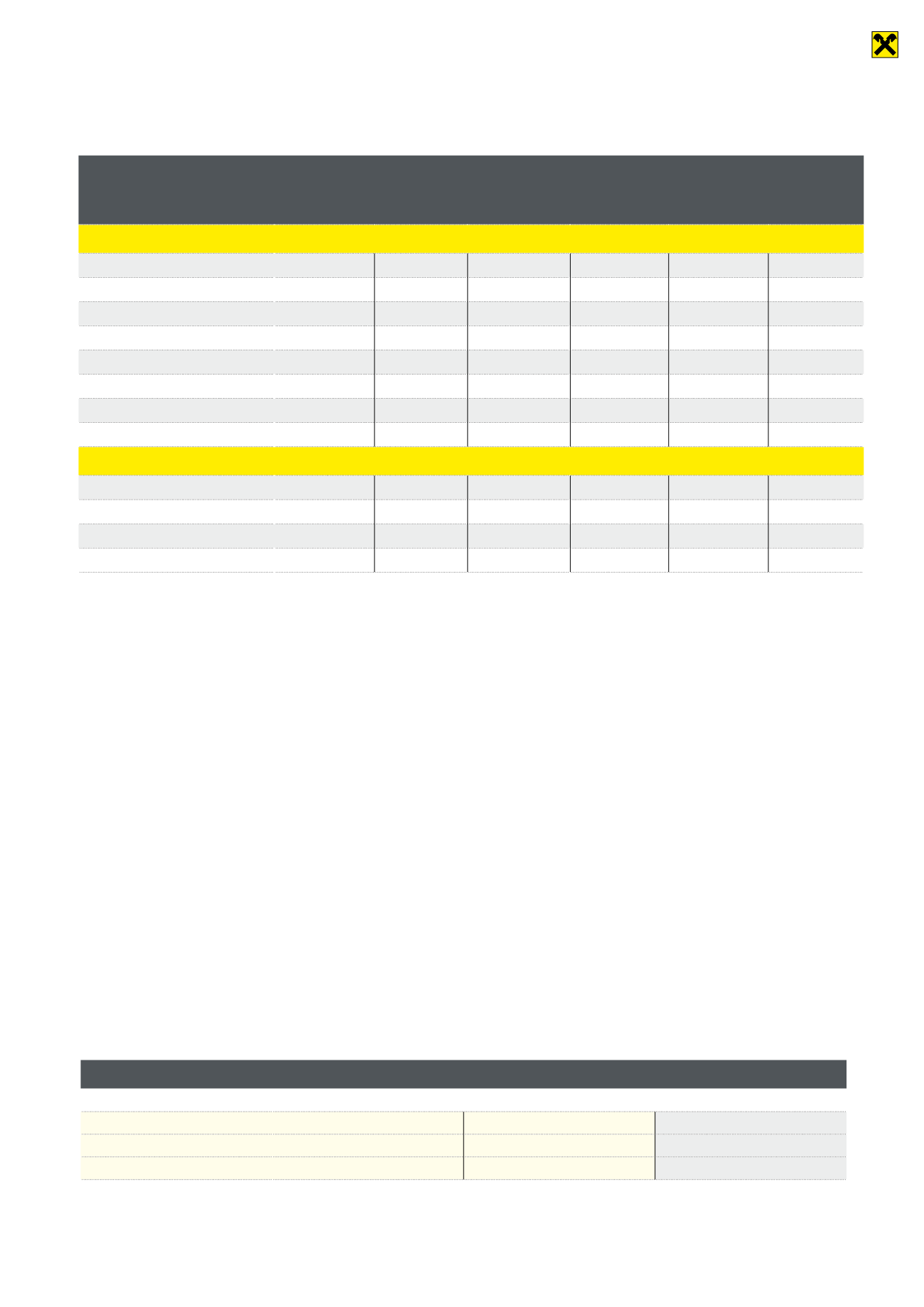

As of the balance sheet date, we held the following derivative financial instruments (in thousands of euros):

Category and type

Banking

book

Remaining terms of nominal values Market val-

ue, positive

Market

value,

negative

Up to 1 year 1 to 5 years More than 5

years

Interest rate derivatives

Interest rate swaps

4,558,872

648,817

1,705,096

2,204,959

177,464

343,726

Previous year

5,089,351

1,067,894

1,938,268

2,083,189

139,836

211,011

Interest rate futures – sale

0

0

0

0

0

0

Previous year

0

0

0

0

0

0

Interest rate options – purchase

240,209

1,189

136,680

102,340

7,363

305

Previous year

288,845

32,000

14,935

241,910

8,741

237

Interest rate options – sale

274,332

1,189

173,767

99,376

528

8,958

Previous year

315,168

32,000

44,836

238,332

376

9,260

Exchange rate derivatives

Currency futures

464

464

0

0

8

11

Previous year

302

302

0

0

0

0

Currency and interest rate swaps

1,238,546

348,747

414,697

475,102

8,992

19,345

Previous year

1,230,569

304,220

407,257

519,092

10,298

59,272

During the financial year, a provision of 3,060,000 euros was formed for open interest rate swaps (previous year: 1,290,000 euros).

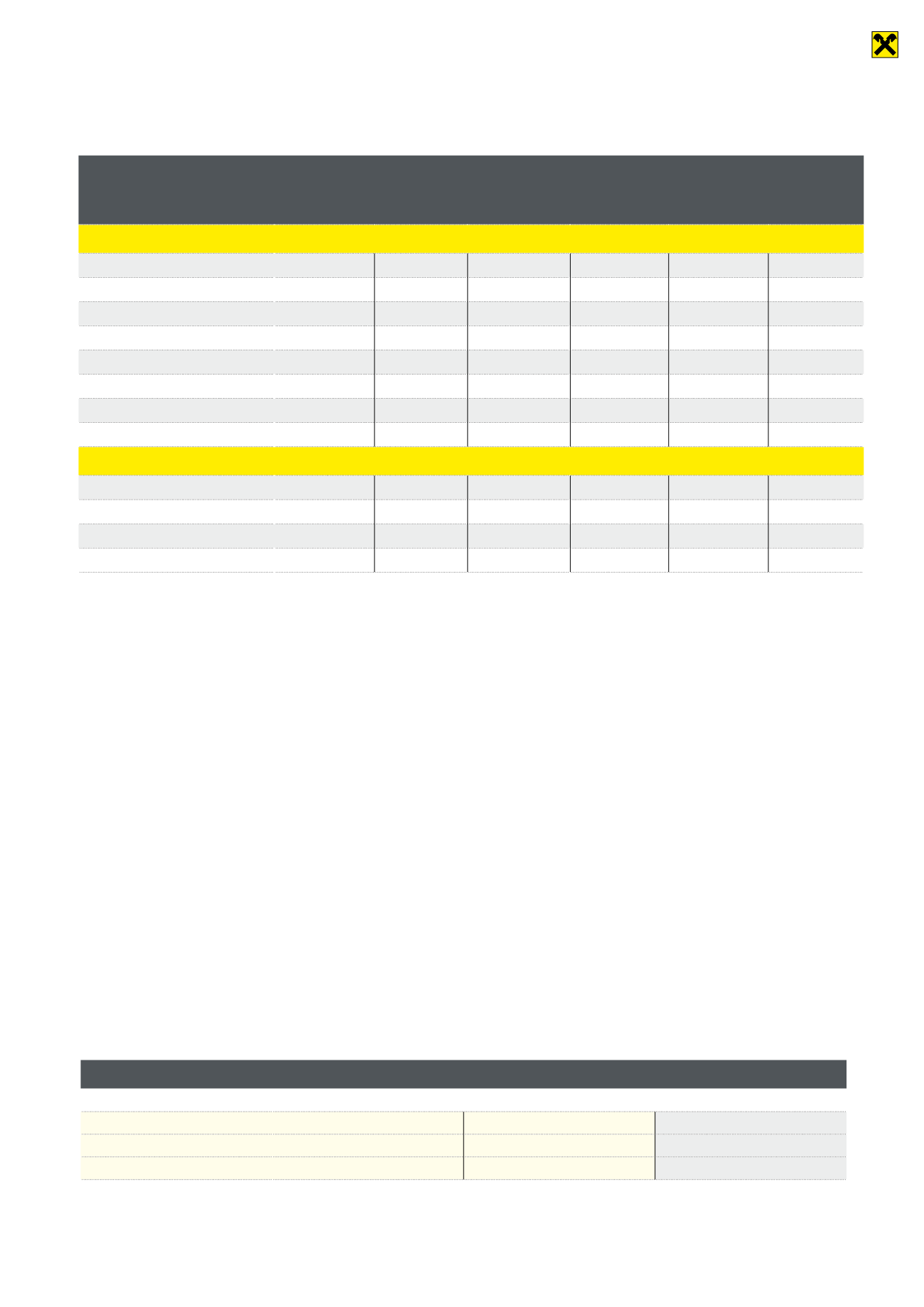

Hedge derivatives

Fair value Negative market value

In euros

In euros

Cap floor

–1,370,719

–9,262,336

Swaps

–166,892,853

–311,132,874

Total

–168,263,572

–320,395,210