39

Notes to the balance sheet

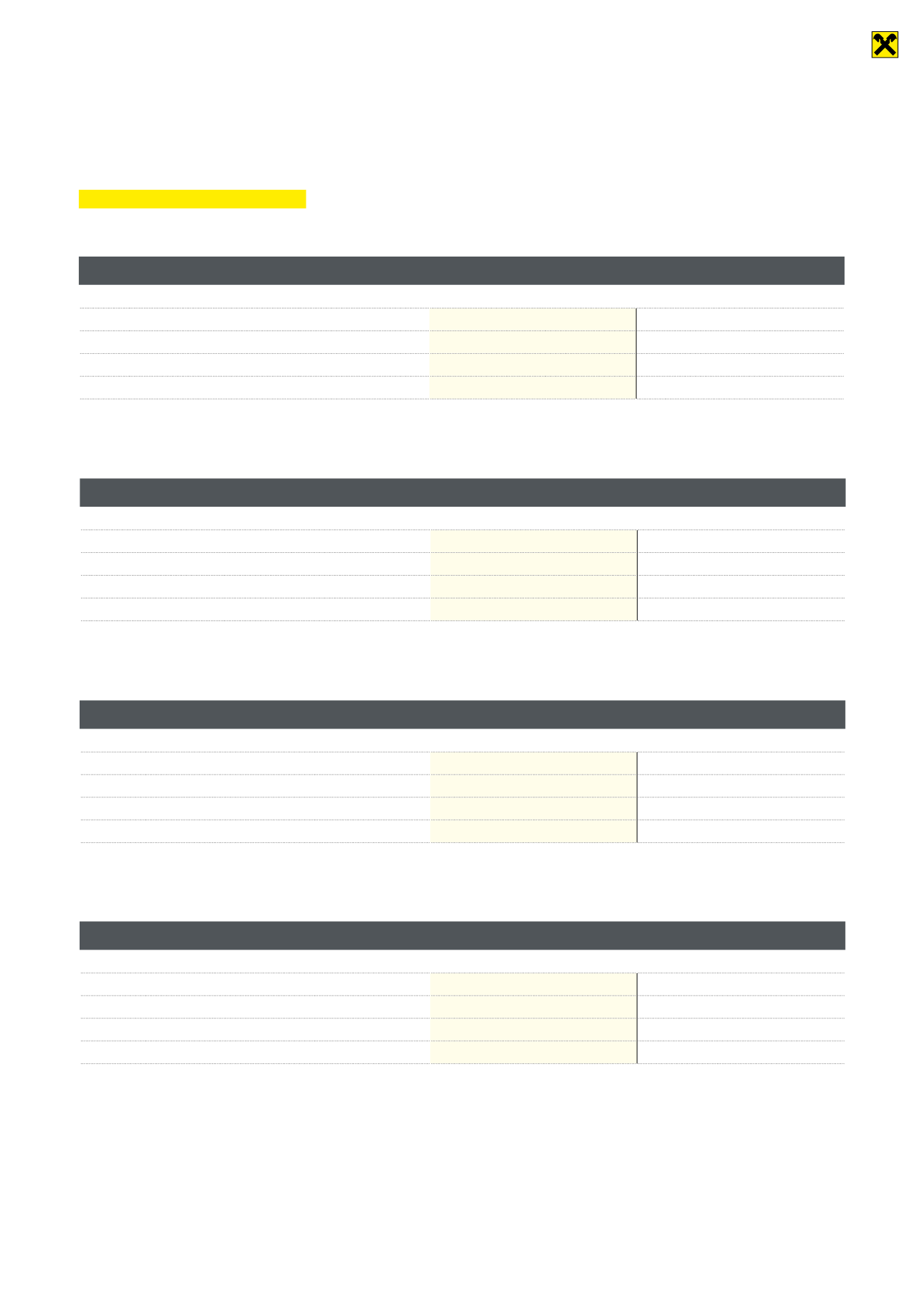

Breakdown of maturity dates

The maturity dates of receivables from banks not maturing daily break down as follows:

Remaining term

31.12.2014

Previous year

In euros

In thousands of euros

Up to 3 months

329,771,255

503,883

3 months to 1 year

527,427,153

481,757

1 year to 5 years

652,336,854

699,677

5 years or more

85,868,481

73,818

Remaining term

31.12.2014

Previous year

In euros

In thousands of euros

Up to 3 months

113,957,700

181,763

3 months to 1 year

387,631,949

439,969

1 year to 5 years

717,116,967

610,035

5 years or more

1,002,338,268

984,490

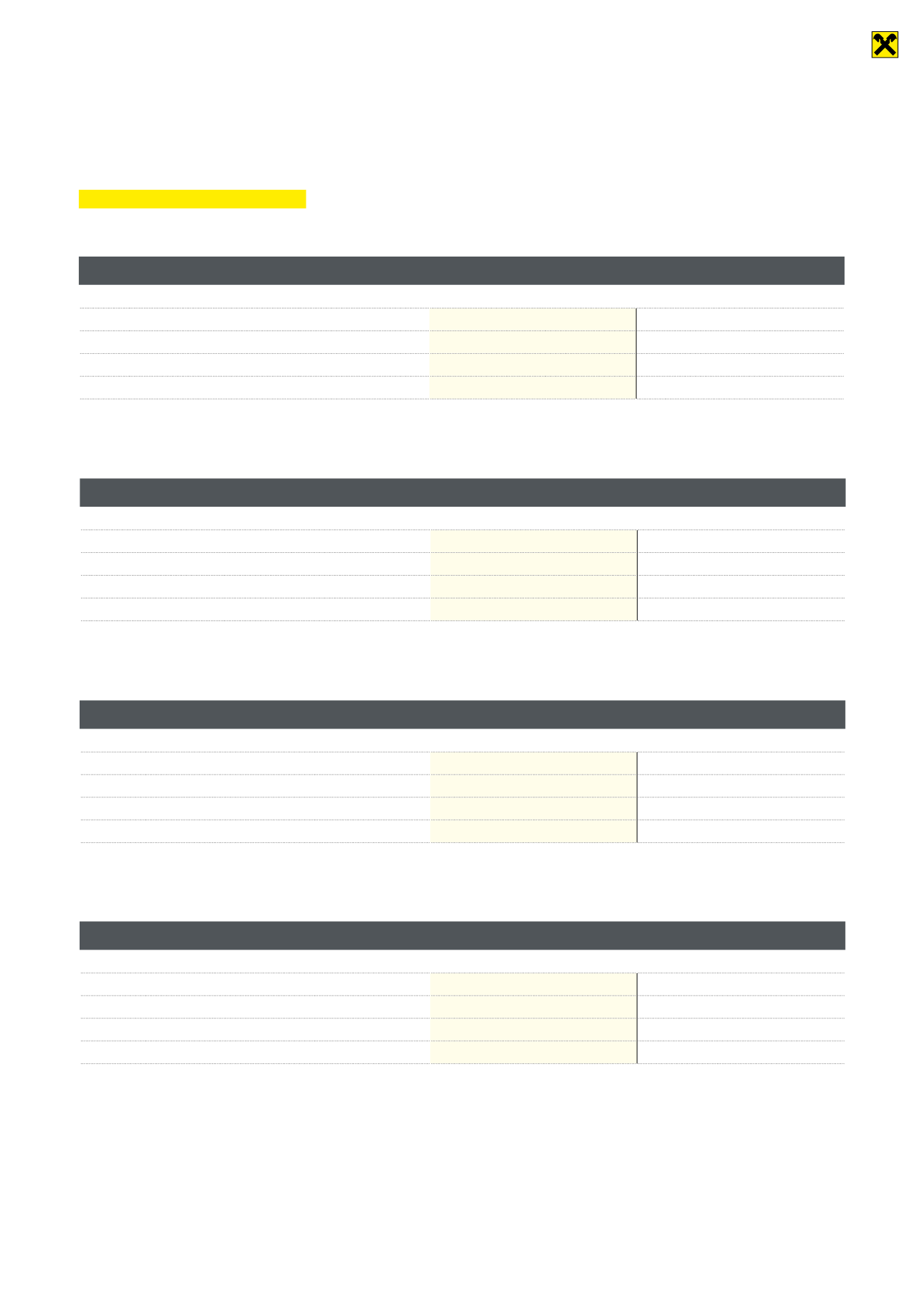

The maturity dates of receivables from non-banks not maturing daily are classified as follows:

Remaining term

31.12.2014

Previous year

In euros

In thousands of euros

Up to 3 months

704,653,784

934,488

3 months to 1 year

191,838,075

268,643

1 year to 5 years

430,766,050

235,722

5 years or more

438,337,500

328,800

The maturity dates of payables to banks not maturing daily are classified as follows:

Remaining term

31.12.2014

Previous year

In euros

In thousands of euros

Up to 3 months

249,202,449

239,951

3 months to 1 year

339,277,241

382,052

1 year to 5 years

218,131,266

235,685

5 years or more

325,788,888

205,818

The maturity dates of payables to non-banks not maturing daily are classified as follows:

In 2015, debt securities and other fixed-interest securities held beneficially totalling 16,265,786 euros (2011: 142,697,000 euros) will ma-

ture.

Annual financial statements