41

Annual financial statements

A result of the switch from Basel II to Basel III in the financial year 2014 and the consequently restricted comparability with the financial

year 2013, the previous year’s figures shall not be indicated.

A result of the switch from Basel II to Basel III in the financial year 2014 and the consequently restricted comparability with the financial

year 2013, the previous year’s figures shall not be indicated.

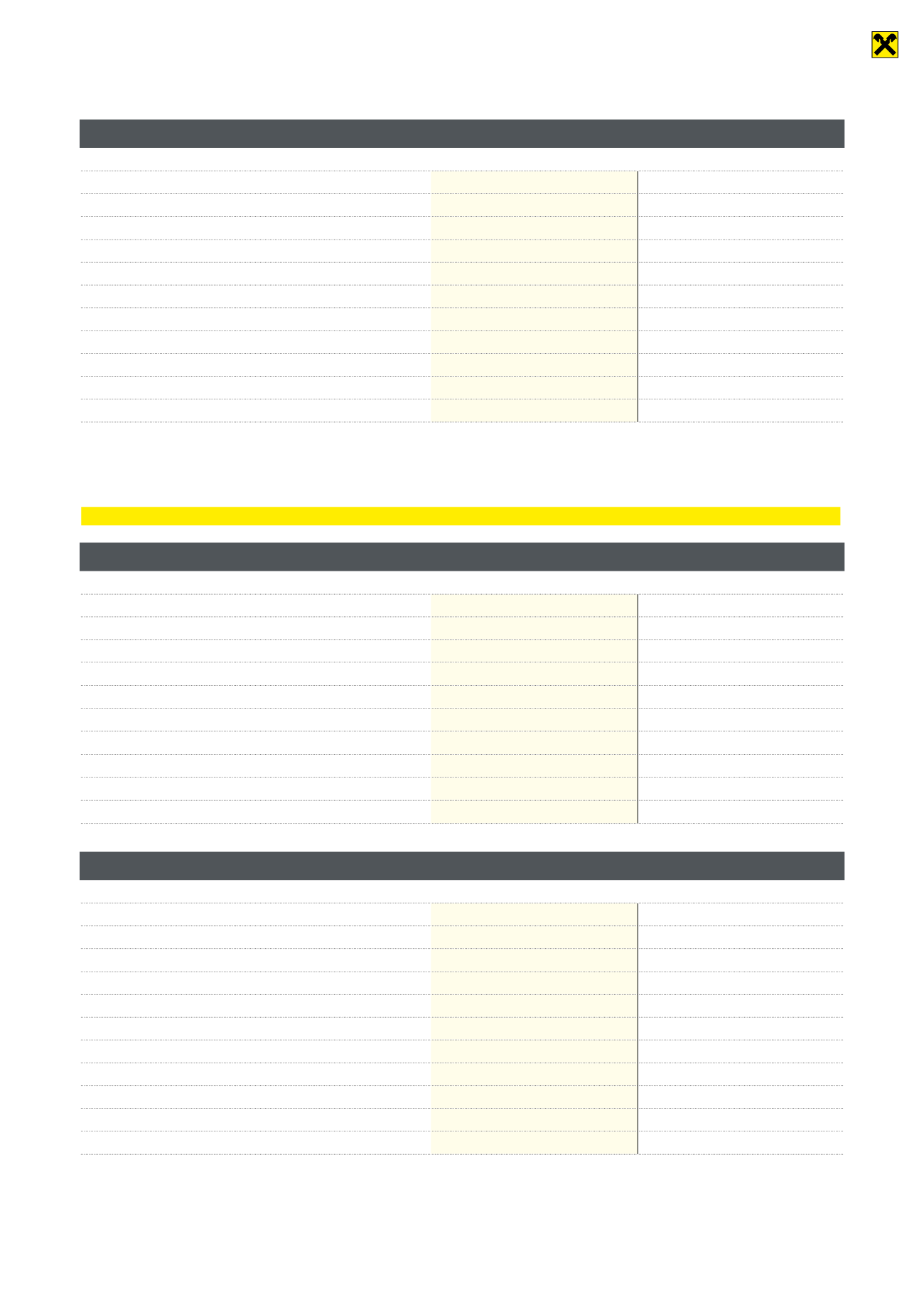

Schedule for the consolidation of the regulatory capital (section 64, paragraph 1, line 17 of the BWG)

Regulatory capital

31.12.2014

In euros

Subscribed capital

84,950,000

Capital reserves

79,342,800

Other reserves

217,251,383

CORE CAPITAL before deductions

381,544,183

Deductions

–2,072,329

CORE CAPITAL

379,471,854

Regulatory capital before deductions

29,572,530

Deductions

–69,463

SUPPLEMENTARY CAPITAL

29,503,067

REGULATORY CAPITAL

408,974,921

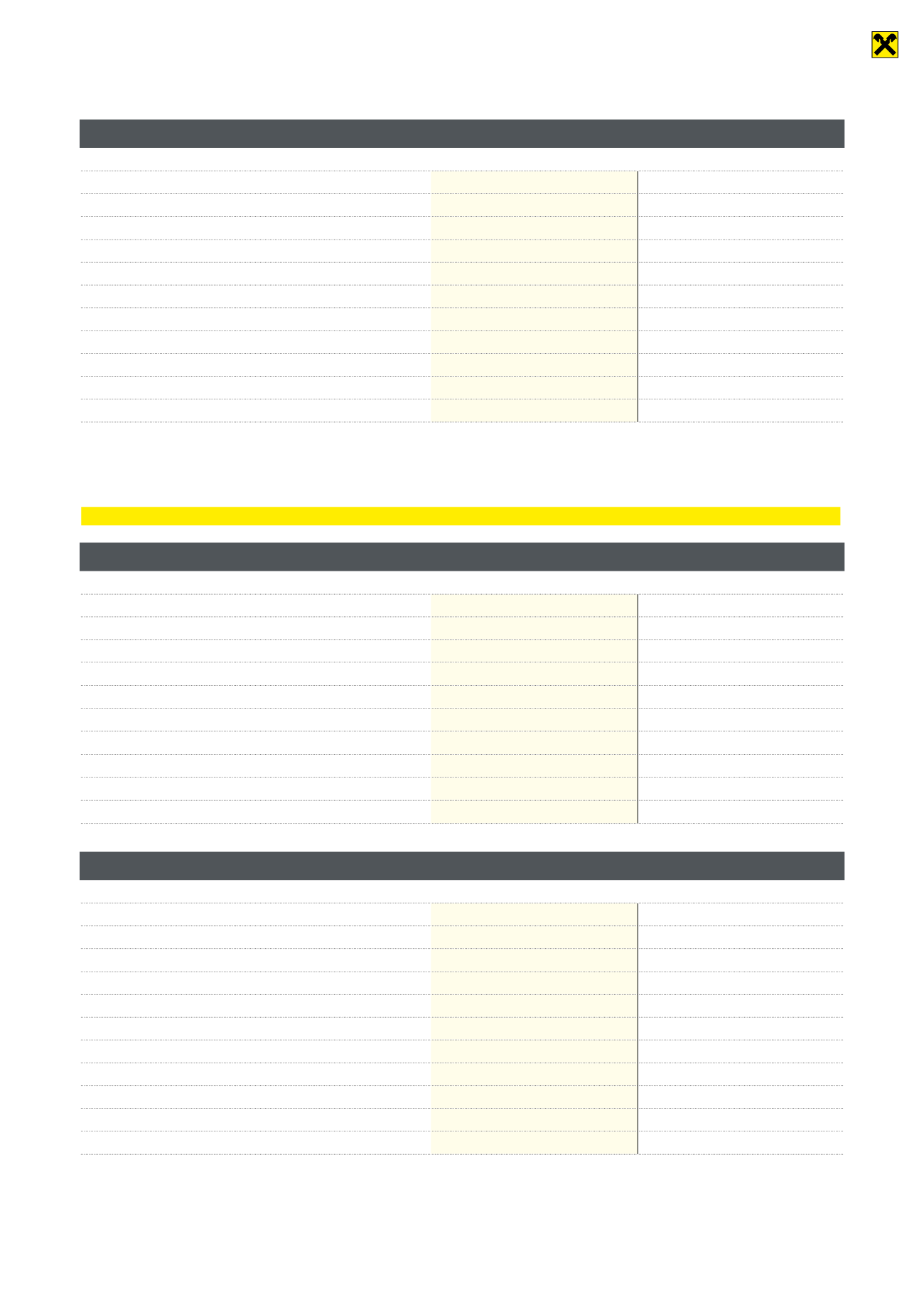

Capital ratios

Ratio

Amount

In euros

Common equity

12.52%

381,544,183

Minimum requirement common equity

4.00%

121,870,841

Common equity surplus

259,673,342

Common equity

12.52%

381,544,183

Minimum requirement common equity

5.50%

167,572,406

Common equity surplus

213,971,777

Regulatory capital total capital

13.49%

411,047,250

Minimum requirement total capital

8.00%

243,741,681

Total capital surplus

167,305,569

Capital ratios

Ratio

Amount

In euros

Common equity

12.24%

379,471,854

Minimum requirement common equity

4.00%

124,039,204

Common equity surplus

255,432,650

Common equity

12.24%

379,471,854

Minimum requirement common equity

5.50%

170,553,906

Common equity surplus

208,917,948

Regulatory capital total capital

13.19%

408,974,921

Minimum requirement total capital

8.00%

248,078,409

Total capital surplus

160,896,513