25

Management report

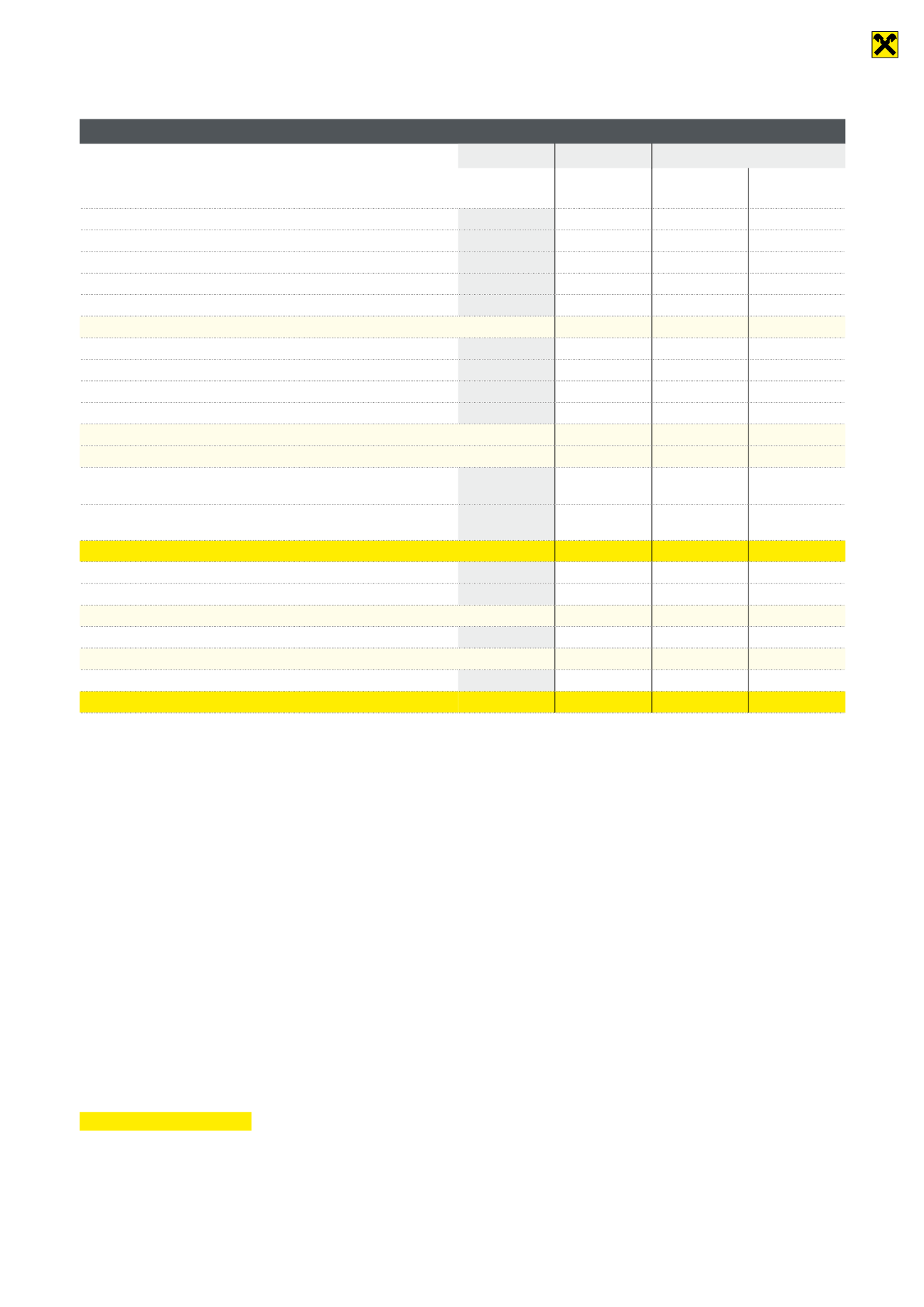

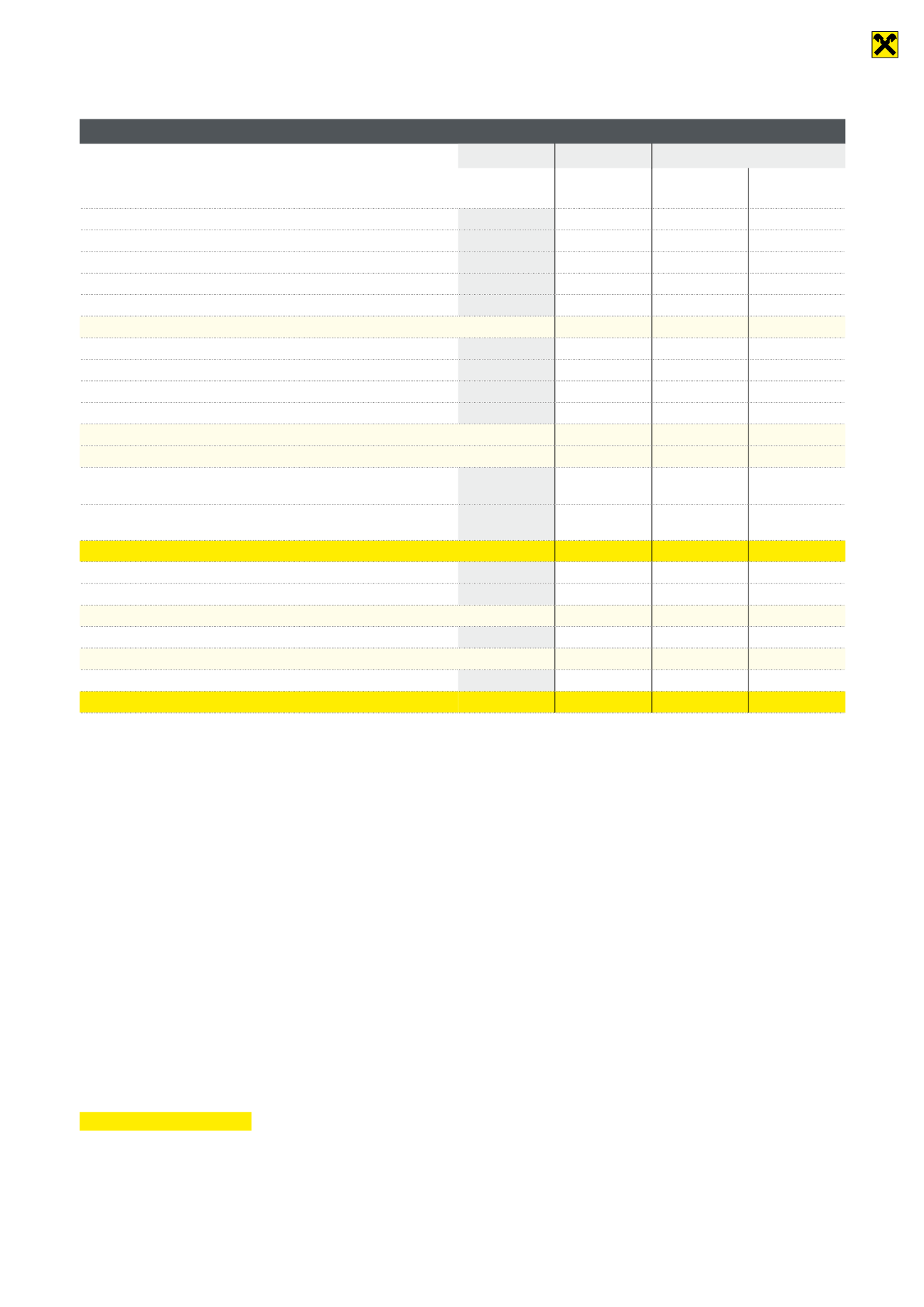

Income statement

2014

2013

Change

Millions of

euros

Millions of

euros

Millions of

euros

Per cent

Net interest income

54.9

56.2

–1.3

–2.3%

Income from securities and investments

17.5

17.8

–0.3

–1.7%

Commission income

22.1

22.4

–0.3

–1.3%

Income from financial transactions

2.1

3.1

–1.0

–32.3%

Other operating income

11.1

11.3

–0.2

–1.8%

OPERATING INCOME

107.7

110.9

–3.2

–2.9%

Personnel costs

–33.9

–38.9

–5.0

–12.9%

Other administrative costs (operating expenses)

–26.1

–26.9

–0.8

–3.0%

Impairment losses on assets

–2.4

–2.6

–0.2

–7.7%

Other operating costs

–3.0

–1.7

1.3

76.5%

TOTAL OPERATING COSTS

–65.4

–70.0

–4.6

–6.6%

OPERATING PROFIT

42.3

40.8

1.5

3.7%

Net expense for impairment losses on receivables

–19.0

–16.0

3.0

18.8%

Net expense for impairment losses on securities and participating

interests

3.2

0.8

2.4

300.0%

Profit from ordinary activities

26.5

25.6

0.9

3.5%

Taxes on income

0.3

–4.1

–4.4

n/a.

Other taxes not posted under previous item

–5.8

–3.6

2.2

61.1%

NET PROFIT

21.0

17.9

3.1

17.3%

Movements in reserves

–12.5

–9.4

3.1

33.0%

ANNUAL PROFIT

8.5

8.5

0.0

0.0%

Profit carried forward

0.0

0.0

0.0

0.0%

Net income

8.5

8.5

0.0

0.0%

In 2014, operating income decreased by 2.9 per cent from 110.9

million euros to 107.7 million euros. This negative development

can be attributed to a decline of 2.3 per cent, or 1.3 million euros,

in net interest income and a decrease of 1.7 per cent, or 0.3

million euros, in income from securities and participating interests.

Commission income, too, showed a slight downward trend of 1.3

per cent, or 0.3 million euros, to 22.1 million euros. Income from

financial transactions was down by 32.3 per cent, 1.0 million euros

lower than in the previous year. Other operating income decreased

by 1.8 per cent in 2014 compared with the previous year, totalling

11.1 million euros.

Operating costs were reduced from 70 million euros to 65.4

million euros, an overall decrease of 6.6 per cent. This was largely

due to the commission income falling by 5 million euros to 33.9

million euros (a 12.9 per cent fall). Likewise on a downward trend

compared to the financial year 2013 were other administrative

costs, which decreased by 3.0 per cent or 0.8 million euros to 26.1

million euros. The valuation allowances for assets were down by

7.7 per cent or 0.2 million euros. They decreased by 2.4 million

euros. Other operating costs, however, increased by 76.5 per cent

or 1.3 million euros to 3.0 million euros.

The balance from reversals of and allocations to impairment losses

on receivables and provisions for contingent liabilities increased by

3.0 million euros or 18.8 per cent. As at year end it consequently

totalled 19.0 million euros. The balance from reversals of and

allocations to impairment losses on securities and participating

interests increased by 2.4 million euros to 3.2 million euros. The

profit from ordinary activities increased by 0.9 million euros, or 3.5

per cent, compared with 2013, totalling 26.5 million euros.

Taxes on income decreased in the financial year 2014 by 4.4

million euros, while other taxes showed an upward trend of 2.2

million euros, or 61.1 per cent, to 5.8 million euros.

The net profit for the year as at year end totalled 21 million euros, an

increase of 3.1 million euros or 17.3 per cent.

12.5 million euros were added to the reserves. This represents an

increase of 3.1 million euros or 33.0 per cent compared with the

financial year 2013.

The profit for the year remained at its previous year’s level of EUR

8.5 million.

Bank branches report

On 31 December 2014, Raiffeisen-Landesbank Tirol AG was operating 13 bank branches and nine self-service banking outlets in its

marketing territory. Three bank branches were converted to self-service outlets in the present year.

All in all, the personnel at RLB Tirol AG looked after the banking needs of just over 68,200 customers.