23

Management report

Review of operations in 2014

Operating income as at 31.12.2014 amounted to 7,079 million euros, lower than the comparable figure at year end 2013. It decreased by

3 per cent. This corresponds to a difference of 220 million euros. Equity increased by 3.5 per cent to 385 million euros in the financial year

2014. Current account deposits, too, were higher, increasing by 10.2 per cent and totalling 1,199 million euros as at 31.12.2014. Liabilities

to banks were reduced from 3,697 million euros to 3,535 million euros. This constitutes a decrease of 4.4 per cent. Compared to the

previous year, savings account deposits decreased by 6.4 per cent to 499 million euros and liabilities evidenced by paper were down by

8.9 per cent to 1,313 million euros. Other liabilities decreased by 20 million euros to 148 million euros, a downturn of 11.9 per cent.

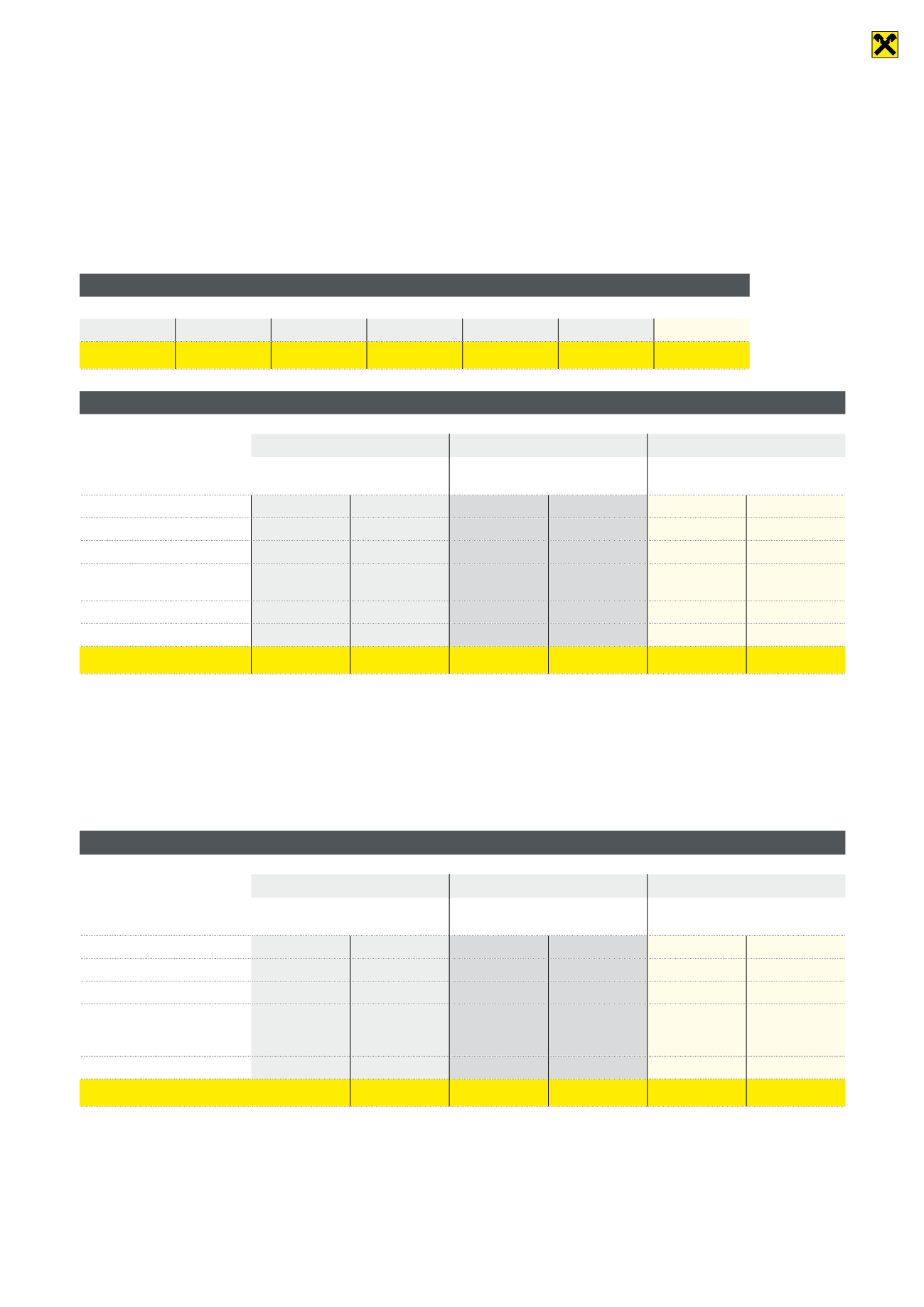

Balance sheet total in millions of euros

31.12.2008

31.12.2009

31.12.2010

31.12.2011

31.12.2012

31.12.2013

31.12.2014

6,654

7,296

7,182

7,356

7,070

7,299

7,079

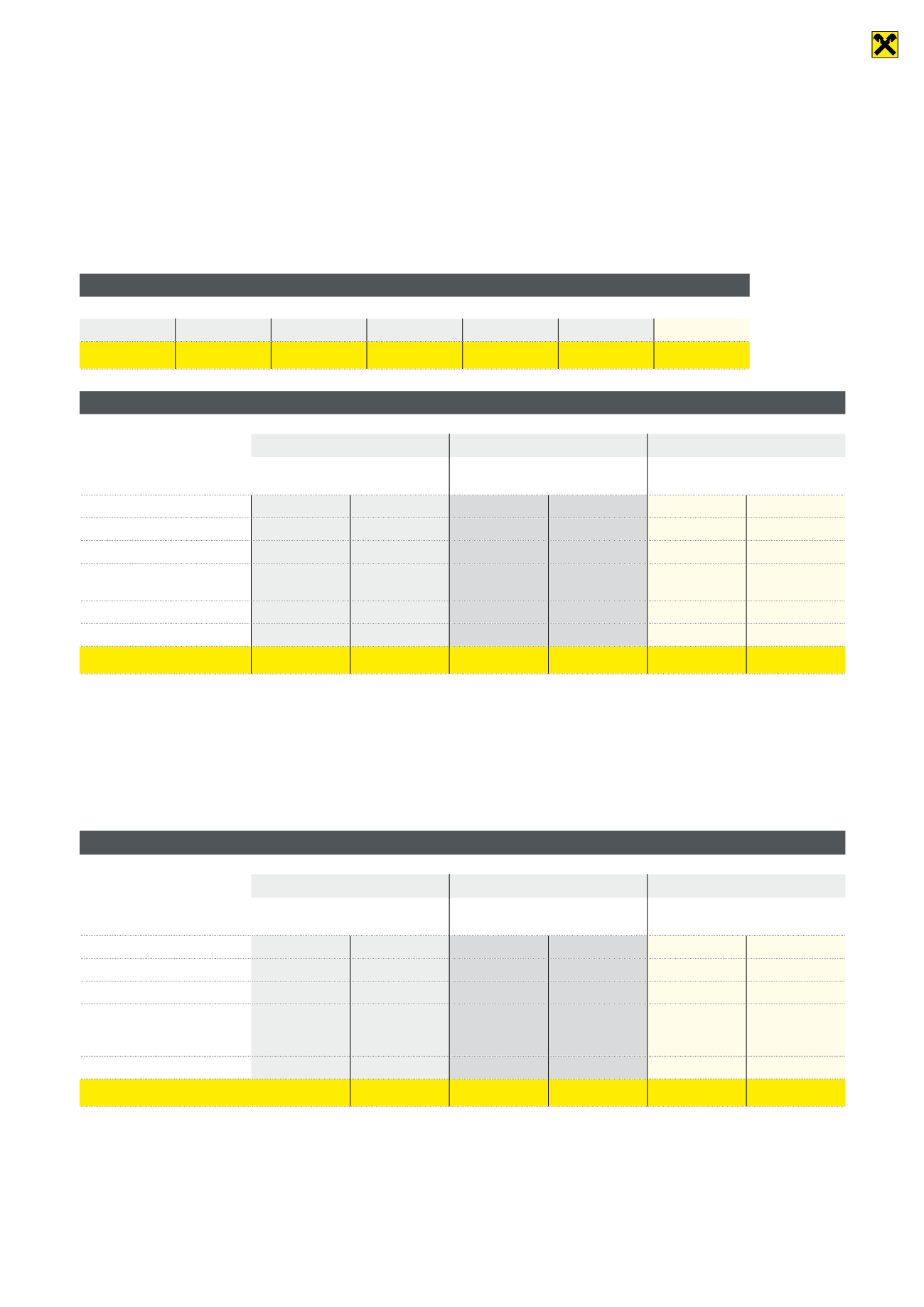

Origin of funds and capital structure

31.12.2014

31.12.2013

Change

Millions of

euros

Per cent

Millions of

euros

Per cent

Millions of

euros

Per cent

Liabilities to banks

3,535

49.9%

3,697

50.7%

–162

–4.4%

Current account deposits

1,199

16.9%

1,088

14.9%

111

10.2%

Savings account deposits

499

7.1%

533

7.3%

–34

–6.4%

Liabilities evidenced by

paper

1,313

18.6%

1,441

19.7%

–128

–8.9%

Equity

385

5.4%

372

5.1%

13

3.5%

Other liabilities

148

2.1%

168

2.3%

–20

–11.9%

Equity and liabilities

7,079

100.0%

7,299

100.0%

–220

–3.0%

Raiffeisen-Landesbank Tirol AG can look back on a satisfactory 2014. Operating income improved by 3.7 per cent over the previous year

from EUR 40.8 million to EUR 42.3 million. Revenue from ordinary activities likewise developed positively, increasing by 3.5 per cent. The

latter increased from EUR 25.6 million to EUR 26.5 million.

On the assets side, receivables from customers have remained unchanged at 2,353 million euros. Participating interests, including shares

in affiliated companies, increased by 9.0 per cent and amounted to 230 million euros as at 31.12.2014. Receivables from banks showed

a downward trend. They decreased by 5.8 per cent from 2,756 million euros to 2,595 million euros compared with the previous year.

Securities owned by the bank likewise showed a negative trend, decreasing by 2.7 per cent to 1,783 million euros. Other assets were

down from 146 million euros to 118 million euros, a decline of 19.2 per cent.

Appropriation of funds and asset structure

31.12.2014

31.12.2013

Change

Millions of

euros

Per cent

Millions of

euros

Per cent

Millions of

euros

Per cent

Receivables from banks

2,595

36.7%

2,756

37.8%

–161

–5.8%

Receivables from customers

2,353

33.2%

2,353

32.2%

0

0.0%

Securities

1,783

25.2%

1,833

25.1%

–50

–2.7%

Participating interests,

including shares in affiliated

companies

230

3.2%

211

2.9%

19

9.0%

Other assets

118

1.7%

146

2.0%

–28

–19.2%

Assets

7,079

100.0%

7,299

100.0%

–220

–3.0%