24

Management report

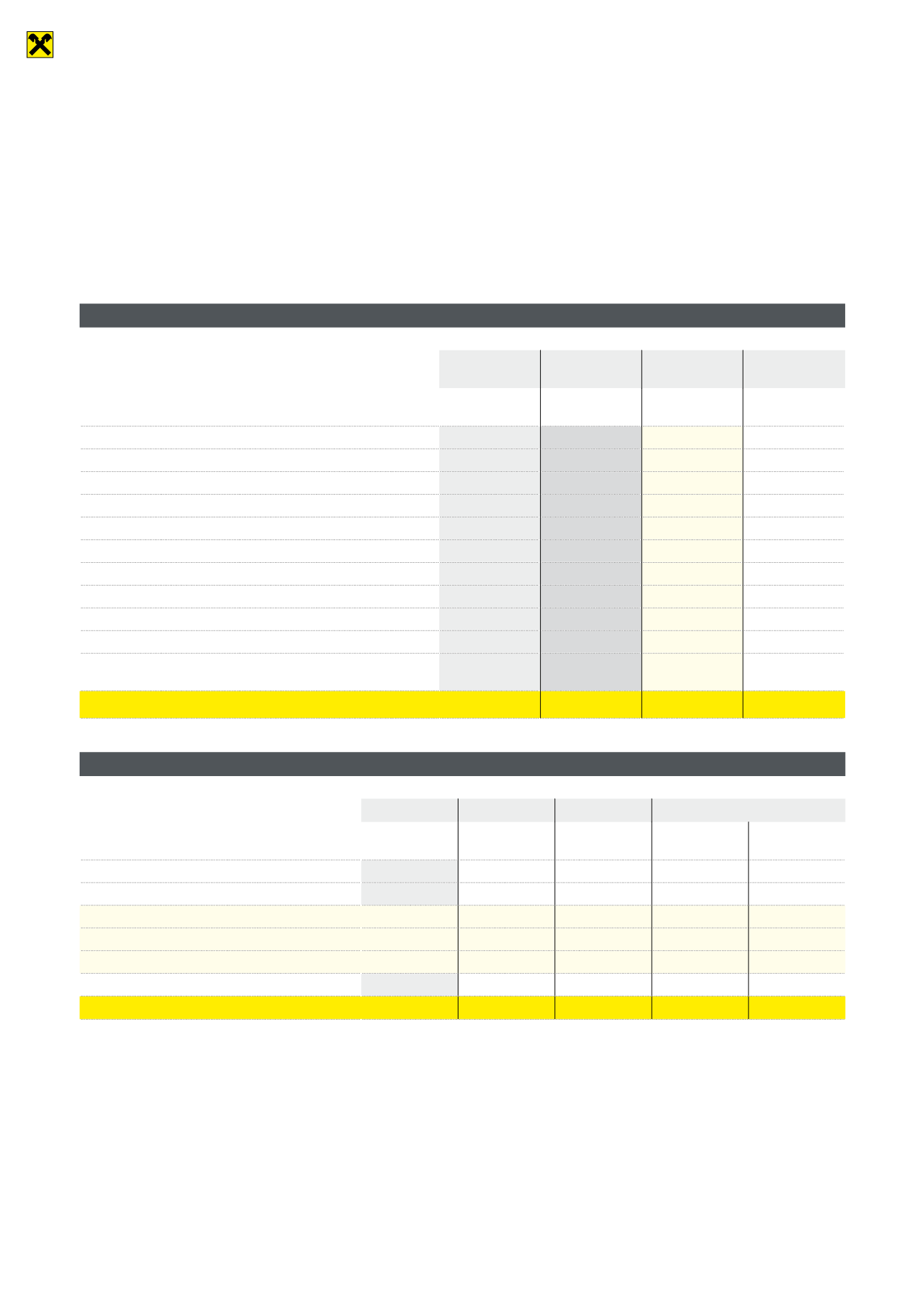

At the end of 2014, receivables from customers broke down as follows:

RLB Tirol AG 2014 breakdown by sector

2014

2013

Change Proportion of

total loans

Thousands of

euros

Thousands of

euros

Per cent

Per cent

Agriculture, forestry and cooperatives

25,489

25,568

–0.3%

1.1%

Transport

141,678

128,830

10.0%

6.0%

Trade

476,935

482,491

–1.2%

20.3%

Manufacturing industry

98,548

85,798

14.9%

4.2%

Employed persons, private

436,114

432,257

0.9%

18.5%

Tourism and leisure industry

372,201

365,780

1.8%

15.8%

Public sector and social insurance

108,971

142,493

–23.5%

4.6%

Self-employed persons

57,081

70,309

–18.8%

2.4%

Commerce

158,632

163,573

–3.0%

6.8%

Others (residential building associations and other non-banks)

481,910

461,597

4.4%

20.5%

Liability reserve pursuant to section 57, paragraph 1 of the

BWG (banking act)

–4,200

–5,700

–26.3%

–0.2%

Total

2,353,359

2,352,996

0.0%

100.0%

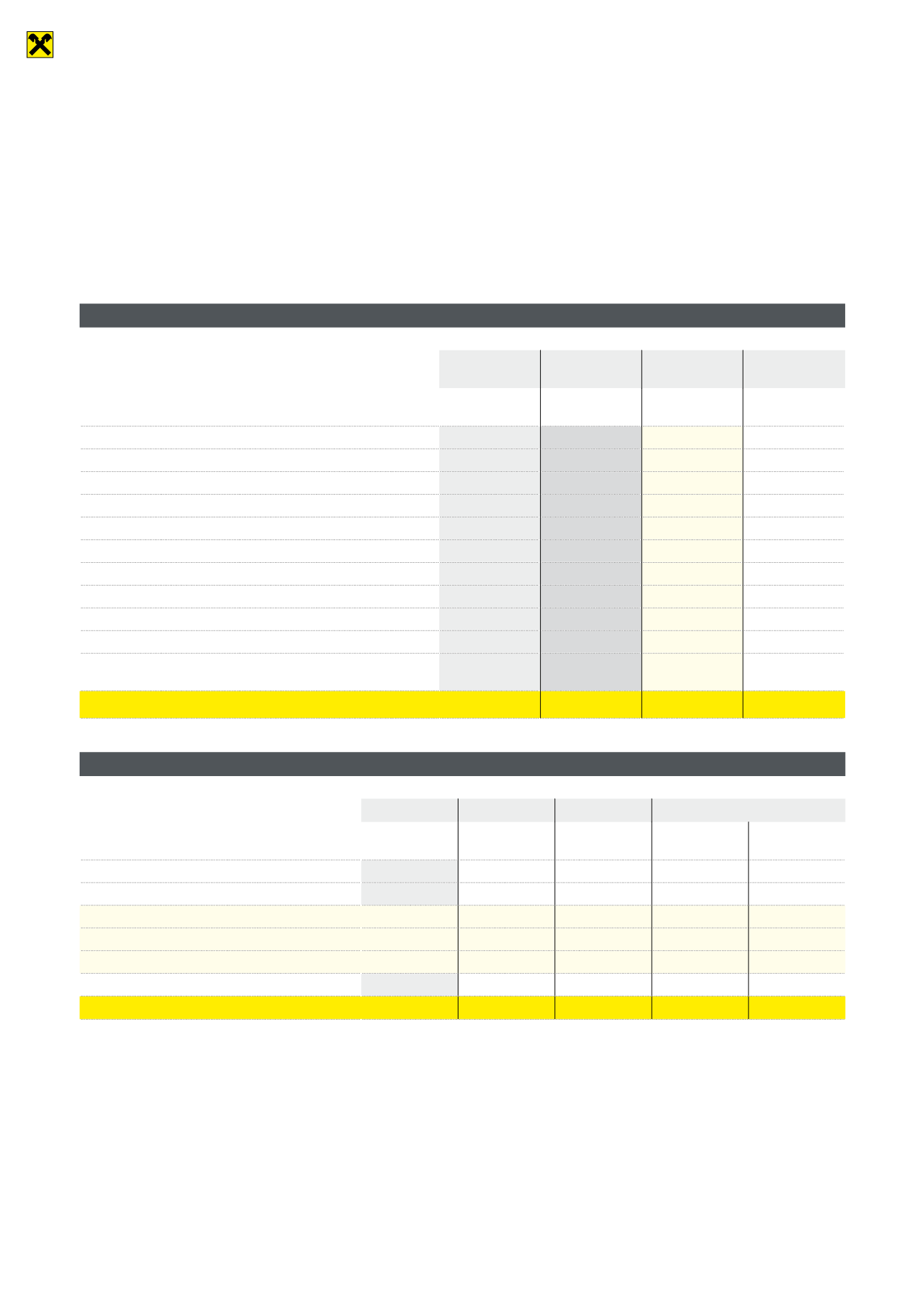

Regulatory capital (pursuant to article 25 CRR)

31.12.2014 31.12.2013 31.12.2012

Change

Thousands of

euros

Thousands of

euros

Thousands of

euros

Thousands of

euros

Per cent

Subscribed capital

84,950

84,950

84,950

Reserves

296,594

287,292

277,883

CORE CAPITAL

381,544

372,242

362,833

9,302

2.5%

SUPPLEMENTARY CAPITAL

29,503

17,838

13,752

11,665

65.4%

REGULATORY CAPITAL before deductions

411,047

390,080

376,585

20,967

5.4%

Deductions

0

–2

–2

REGULATORY CAPITAL

411,047

390,078

376,583

20,969

5.4%